By Joe Szabo, Scottsdale Real Estate Team

For some home buyers, the closing day for a real estate purchase is as formal and complicated as the transaction itself. For others, it’s just a blip on the radar. Either way, there are some important things to keep in mind as you make your way to homeownership.

By Joe Szabo, Scottsdale Real Estate Team

For some home buyers, the closing day for a real estate purchase is as formal and complicated as the transaction itself. For others, it’s just a blip on the radar. Either way, there are some important things to keep in mind as you make your way to homeownership.

Home Buyers: 5 Things to Know As You Wait for Closing Day By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

For some home buyers, the closing day for a real estate purchase is as formal and complicated as the transaction itself. For others, it’s just a blip on the radar. Either way, there are some important things to keep in mind as you make your way to homeownership.

By Joe Szabo, Scottsdale Real Estate Team

For some home buyers, the closing day for a real estate purchase is as formal and complicated as the transaction itself. For others, it’s just a blip on the radar. Either way, there are some important things to keep in mind as you make your way to homeownership.

In spring (after the last frost) move it outdoors to a sunny spot, provide fertilizer, closely monitor for slugs, and water regularly. Starting in mid-August, allow the potting mix to dry out completely between waterings. When you see a flower bud about eight weeks later, move the plant to a sunny spot (direct sun is fine) to get a strong and sturdy stem, and resume regular watering. Once the flowers have opened, display your amaryllis with pride.

In spring (after the last frost) move it outdoors to a sunny spot, provide fertilizer, closely monitor for slugs, and water regularly. Starting in mid-August, allow the potting mix to dry out completely between waterings. When you see a flower bud about eight weeks later, move the plant to a sunny spot (direct sun is fine) to get a strong and sturdy stem, and resume regular watering. Once the flowers have opened, display your amaryllis with pride.

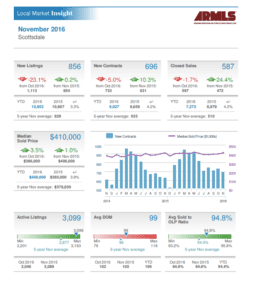

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

If you’re considering to purchase or sell a property in Scottsdale we invite you to reach out to Joe and Linda Szabo with The Szabo Group – The Scottsdale Real Estate Experts! They and their team are more than happy to assist you with any of your real estate needs.

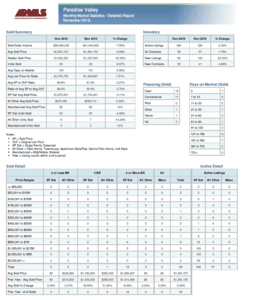

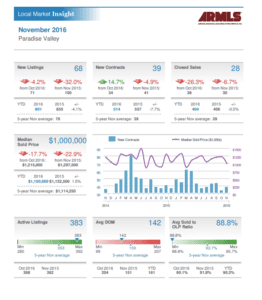

We hope that you enjoy reading and analyzing the Paradise Valley Lux ury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

If you’re considering to purchase or sell a property in Scottsdale we invite you to reach out to Joe and Linda Szabo with The Szabo Group – The Scottsdale Real Estate Experts! They and their team are more than happy to assist you with any of your real estate needs.

We hope that you enjoy reading and analyzing the Paradise Valley Lux ury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

By

By