By Joe Szabo, Scottsdale Real Estate Team

The era of “Mad Men” has come and gone, but the love of all things retro is here to stay. Not only are vintage pieces a fantastic way to recharge a space, but they can even save you a few pennies.

Here are our favorite ways to add a retro touch without completely dedicating the look of your home to the style.

By Joe Szabo, Scottsdale Real Estate Team

The era of “Mad Men” has come and gone, but the love of all things retro is here to stay. Not only are vintage pieces a fantastic way to recharge a space, but they can even save you a few pennies.

Here are our favorite ways to add a retro touch without completely dedicating the look of your home to the style.

5 Ways to Add a Retro Touch to Your Home By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

The era of “Mad Men” has come and gone, but the love of all things retro is here to stay. Not only are vintage pieces a fantastic way to recharge a space, but they can even save you a few pennies.

Here are our favorite ways to add a retro touch without completely dedicating the look of your home to the style.

By Joe Szabo, Scottsdale Real Estate Team

The era of “Mad Men” has come and gone, but the love of all things retro is here to stay. Not only are vintage pieces a fantastic way to recharge a space, but they can even save you a few pennies.

Here are our favorite ways to add a retro touch without completely dedicating the look of your home to the style.

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

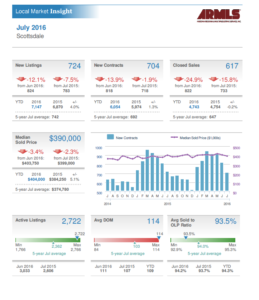

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at  By

By  By

By  By

By  By

By  By

By  By

By  By

By  By

By