By Joe Szabo, Scottsdale Real Estate Team

When it comes time to sell a home, every seller wants the same outcome: to sell quickly, for as much money as possible.

According to a new Zillow analysis, listing a home toward the end of spring significantly increases a seller’s chances of making this happen.

In all but five of the country’s 25 biggest metro markets, the best month to put a home on the market is April or May. Homes listed in the first half of May sold nine days faster and for almost 1 percent more money than average listings. (You may have even better luck if you’re in one of the best U.S. markets for home sellers.)

By Joe Szabo, Scottsdale Real Estate Team

When it comes time to sell a home, every seller wants the same outcome: to sell quickly, for as much money as possible.

According to a new Zillow analysis, listing a home toward the end of spring significantly increases a seller’s chances of making this happen.

In all but five of the country’s 25 biggest metro markets, the best month to put a home on the market is April or May. Homes listed in the first half of May sold nine days faster and for almost 1 percent more money than average listings. (You may have even better luck if you’re in one of the best U.S. markets for home sellers.)

The low supply of homes on the market has pushed the ideal window later in the spring. Many shoppers who start searching for a home in early spring may need to look at several homes and make multiple offers, and may still be shopping a few months later.

By May, some buyers will be anxious to avoid more disappointment or eager to get settled into a new home before the next school year — and will be more willing to pay a premium to close the deal.

The May sales boost was particularly notable in Seattle and Portland where sellers who listed in the first half of the month stand to gain the biggest price boost — 2.5 percent in Seattle, 2 percent in Portland — over the area’s average.

On the other end, typically warm weather regions like Miami, Tampa and Phoenix tend show very little variation in sales price or time on market based on listing months. Sellers in these markets will find themselves with more flexibility in choosing when to sell their home.

To apply this analysis to their own home, sellers can use Zillow’s Best Time to List tool to estimate how much listing timing will influence the final sale price in their neighborhood. Registered Zillow users access the tool by clicking the “Sell Your Home” tab on the home details page of their home, and obtain valuable information to pair with the expertise of a local real estate agent when determining the best time to put their home on the market.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

The low supply of homes on the market has pushed the ideal window later in the spring. Many shoppers who start searching for a home in early spring may need to look at several homes and make multiple offers, and may still be shopping a few months later.

By May, some buyers will be anxious to avoid more disappointment or eager to get settled into a new home before the next school year — and will be more willing to pay a premium to close the deal.

The May sales boost was particularly notable in Seattle and Portland where sellers who listed in the first half of the month stand to gain the biggest price boost — 2.5 percent in Seattle, 2 percent in Portland — over the area’s average.

On the other end, typically warm weather regions like Miami, Tampa and Phoenix tend show very little variation in sales price or time on market based on listing months. Sellers in these markets will find themselves with more flexibility in choosing when to sell their home.

To apply this analysis to their own home, sellers can use Zillow’s Best Time to List tool to estimate how much listing timing will influence the final sale price in their neighborhood. Registered Zillow users access the tool by clicking the “Sell Your Home” tab on the home details page of their home, and obtain valuable information to pair with the expertise of a local real estate agent when determining the best time to put their home on the market.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

By

By

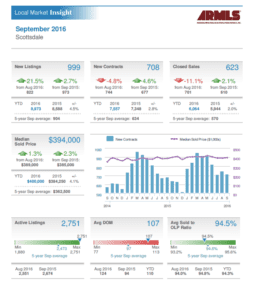

Fall is here and the weather is finally cooling down! Our winter residents are returning to the Valley and we will soon see the influx of welcome visitors and buyers. Let’s take a look at how the real estate market fared in September 2016. New listings are up 21.5% from August with a total of 999 new listings vs. 822 in August. New contracts are down by 4.8% and closed sales are down by 11.1%. The median sale price has gone up from $389,000 in August to $394,000 in September. Keeping up with the current market is always important especially when you’re looking to buy and sell a home. It will be interesting to see where Scottsdale’s market ends up once the election is over. During these up and down activity months it is more important than ever to consult a real estate professional that knows the Scottsdale market.

If you’re considering purchasing or selling a property in Scottsdale give the The Szabo Group a Call – The Real Estate Experts.

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Fall is here and the weather is finally cooling down! Our winter residents are returning to the Valley and we will soon see the influx of welcome visitors and buyers. Let’s take a look at how the real estate market fared in September 2016. New listings are up 21.5% from August with a total of 999 new listings vs. 822 in August. New contracts are down by 4.8% and closed sales are down by 11.1%. The median sale price has gone up from $389,000 in August to $394,000 in September. Keeping up with the current market is always important especially when you’re looking to buy and sell a home. It will be interesting to see where Scottsdale’s market ends up once the election is over. During these up and down activity months it is more important than ever to consult a real estate professional that knows the Scottsdale market.

If you’re considering purchasing or selling a property in Scottsdale give the The Szabo Group a Call – The Real Estate Experts.

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at  By

By

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at