We at Scottdale Real Estate Team off your best wishes for a wonderful holiday season and a new year filled with peace, prosperity and happiness. Happy holidays and a very happy 2018!

We at Scottdale Real Estate Team off your best wishes for a wonderful holiday season and a new year filled with peace, prosperity and happiness. Happy holidays and a very happy 2018!

Overpricing: How Aiming Too High Can Cost You By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Pricing a home for sale is more of an art than a science. Each home’s value falls within a range, and the price the buyer and seller agree on determines the exact value of the property.

If priced competitively from the very beginning, a home will sell at the higher end of the value range. The longer it lingers, the lower it lands in that range.

In fact, “homes that linger on the market tend to sell for significantly less than their listing price: five percent less after two months,” according to Zillow research.

By Joe Szabo, Scottsdale Real Estate Team

Pricing a home for sale is more of an art than a science. Each home’s value falls within a range, and the price the buyer and seller agree on determines the exact value of the property.

If priced competitively from the very beginning, a home will sell at the higher end of the value range. The longer it lingers, the lower it lands in that range.

In fact, “homes that linger on the market tend to sell for significantly less than their listing price: five percent less after two months,” according to Zillow research.

Price: The battle between seller and agent

Homeowners have a very limited perspective on the real estate market, as they are only concerned with one home: their own. On the other hand, successful agents live and breathe their local markets daily. They have their feet on the street, and possess a great understanding of current market conditions because they work with buyers, tour homes, and have first-hand knowledge of what moves. Because they have limited knowledge, many sellers over-value their homes. They may assume that the agent just wants to price their home — their biggest asset — at a low price for a quick sale. And so a friction begins. But agents know that homes that are priced right and show well will sell in good times and bad.First impressions make the difference

The market typically responds to a new listing in the first few weeks, so do everything you can to make it attractive to buyers right from the start. Price your home right, and take all of your agent’s advice about cleaning, de-cluttering, painting and prepping, and your home should sell without incident, and for top dollar. List at the wrong price or with the home not in its best showing condition, and you’ll leave a poor first impression on the market. As time passes, a listing starts to lose its momentum as newer, more competitive homes come up for sale. As the number of days on the market increases, interest in your home decreases, and the listing becomes stale.Next stop: price reduction

A price reduction inevitably occurs after weeks or months of inactivity. If the seller doesn’t price the home within striking distance (say, five percent in many markets) of what the buyer perceives the value to be at the time, the seller has to come down in price. Often, they come down, but still not enough. If the sellers miss the market twice, buyers won’t take them seriously, and will wait around for the next reduction. The home will eventually get into the right price range for the market, and a buyer will strike. But they will probably punish the seller by coming in with an offer far lower than they would have, had the home come onto the market at the right price. Once sellers lose the momentum of being new on the market, they’re at a disadvantage when it comes time to negotiate.Risk of the market changing

What’s worse is that markets can start to decline over time. A seller may list in March to a healthy market, but their odds of making a top-dollar sale fall as inventory piles up, the economy slows, interest rates rise, or any number of factors come into play. Come September, the value range of the home is lower than it was in March. A change in market conditions is a risk a seller takes by pricing too high.Risk of showing poorly

As time passes, sellers may get lazy, and keeping the house clean and organized becomes a chore. Weeds come back, dust bunnies creep up, and the house doesn’t show as well as it did when it first went on the market. Buyers who show up when the price is right will have even more reason to penalize the seller with a low offer.Advice to sellers

If you are serious about selling your home and have a game plan and motivation to move on, take pricing very seriously. If you and your agent disagree about the price, but not by a lot, it’s worth trying the higher number. But have an upfront plan to reduce the price quickly, and use that price reduction as a marketing activity. The market will respond positively to a seller who shows they are serious about selling. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.Getting and Staying Organized Through the Summer By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Sometime about now in mid-summer we begin asking ourselves, “Why do things seem to be out of control? I planned on organizing my photos, painting that cute dresser I picked up at the yard sale last fall, and waking up without an alarm clock on Fridays. None of it has happened!”

This scenario is all too common — and yet there is good news. It’s never too late to get and stay organized for the remainder of the summer.

People tend to get busy with outdoor activities and become distracted by vacations, plus household schedules and routines tend to be different than during the school year. The most common areas that seem to spiral out of control are:

By Joe Szabo, Scottsdale Real Estate Team

Sometime about now in mid-summer we begin asking ourselves, “Why do things seem to be out of control? I planned on organizing my photos, painting that cute dresser I picked up at the yard sale last fall, and waking up without an alarm clock on Fridays. None of it has happened!”

This scenario is all too common — and yet there is good news. It’s never too late to get and stay organized for the remainder of the summer.

People tend to get busy with outdoor activities and become distracted by vacations, plus household schedules and routines tend to be different than during the school year. The most common areas that seem to spiral out of control are:

- Summer clutter

- Project procrastination

- Sleep routines

Summer clutter

We’re conditioned to create traditions and rituals. We buy new outdoor furniture and decorations for our backyard barbecue, and bring friends and family together for camping trips chock full of new-fangled gadgets and equipment. We have family reunions and summer vacations. We’re used to buying, creating, and preparing for events — yet we don’t really have a method or system to deal with the aftermath. It may be time to say goodbye to the stuff we buy “on the fly,” like walkie talkies for playful banter on road trips, floaties for the swimming pool, collapsible picnic tables for the beach, croquet sets for the backyard, and rain ponchos for the fast-moving and sudden rainstorm. I recommend two steps for handling summer clutter:- Collect all the summer clutter. Empty the souvenir bags, toiletry kits, suitcases, and backpacks. Get it all in one place.

- Evaluate it. I do this by using a value-based point system. Rate each item on a scale of 0 to 5. Zero means you have no real use for it in the future and don’t like it at all. Five means you really love the item and can use it, or it brings you great joy to keep it.

Project procrastination

Often we feel more disorganized or confused about our perceived “free time” during the summer months. This can happen because we spend the first half of the year postponing projects until summer vacation. Each year we stack the projects-in-waiting for summer, and each year we seem to forget that we would really rather enjoy some time off in nature, traveling, or getting together with friends. If you want to reduce the pressure for yourself, release yourself from too many good intentions, like repainting the powder room; reading the stack of books you’ve collected; and that wishful photo-organizing project. Instead, pick just one project and focus on it. By making one project the priority, you can do little bits of it from time to time. So, instead of putting off the project and feeling badly that it isn’t getting done, break your priority project down into doing one small step per day.Sample summer project

Want to paint that dresser? Allow yourself 13 “moments” to complete the project and never miss a bit of summer fun. Use this project breakdown to make any project fit in around your unpredictable summer schedule. Painting a dresser purchased at a yard sale- Take a “before” picture: 30 seconds

- Make a list of supplies needed: 5 minutes

- Buy paint and supplies: 1 hour

- Stage the area where you plan to paint: 15 minutes

- Pull the drawers out of the dresser: 3 minutes

- Remove the knobs from the drawers: 10 minutes

- Sand the dresser and drawers: 35 minutes

- Wipe down the dresser and drawers: 10 minutes

- Paint just a drawer or two (repeat): 30 minutes

- Paint the frame of the dresser: 1 hour

- Re-attach knobs: 20 minutes

- Move dresser to preferred location: 20 minutes

- Take picture and post for friends to see: 3 minutes

Sleep routines

Most of us realize instinctively that sleep is important. “You know that babies and children need sleep to grow,” says Val Sgro, a professional organizer and author. “You know that an injured body heals itself faster with good sleep. You know that if you don’t get enough sleep, you become sluggish and cranky, and you have trouble thinking straight. That old saying, ‘I’ll sleep on it,’ comes from the realization that the solution to a problem often seems to reveal itself after a good night’s sleep. “Contrary to common belief, your brain does not rest when you sleep,” she continues. “It is often more active than when you’re awake. It’s busy — busy making sure it stays organized.” And therein lies the key to getting and staying organized in the summer months. Though our sleep routines will likely be off kilter, it’s worth asking the question, “How will I be able to get seven or eight hours of sleep tonight? How will I fit it in?” Maybe you need to grab a mid-day nap or put yourself (not just the kids) to bed an hour earlier. Getting more sleep will help you make better decisions when you pack (and thus have fewer items to “buy on the fly” while traveling). More sleep means being more alert driving on road trips; consuming less sugar or caffeine for a mid-day boost; and showing up with an overall better outlook for the day. And in the middle of summer travel or hosting guests who are visiting for a week, that couldn’t be a more welcome benefit. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.New Mortgage Rules For Self-Employed Borrowers By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

If you’re self-employed, you must meet different requirements than a salaried person to qualify for a mortgage. The rules about how that works were updated in recent months to take an even closer look at your business income, so let’s review the rules for self-employed people borrowing for the first time, and for those who will be impacted by new rules next time they get a loan.

By Joe Szabo, Scottsdale Real Estate Team

If you’re self-employed, you must meet different requirements than a salaried person to qualify for a mortgage. The rules about how that works were updated in recent months to take an even closer look at your business income, so let’s review the rules for self-employed people borrowing for the first time, and for those who will be impacted by new rules next time they get a loan.

Self-employed borrower basics

Two of the most important things lenders review to qualify you for a mortgage are income and assets, which respectively, determine how much monthly payment you can afford and where your down payment is coming from. When it comes to income, self-employed borrowers report income as sole proprietors or owners of entities like corporations, partnerships, or limited liability companies (LLCs). As a sole proprietor, you will file your self-employed income on IRS Schedule C, which tracks your income and expenses for a given year. Unlike with salaried employees, who get to use their gross income for loan qualifying, sole proprietor borrowers must qualify using their net income from Schedule C. Furthermore, lenders calculate a 24-month average of net income for sole proprietors (as opposed to sometimes requiring just one year from salaried borrowers), and if the most recent Schedule C has lower net income than the previous year, lenders will use worst-case income by calculating a 12-month average of the most recent year. If you’re self-employed and conduct business via a corporation, partnership, or LLC, the IRS requires these entities to file separate sets of tax returns. If you own 25 percent or more of the entity, you will need to provide lenders with these full business tax returns, as well as your personal returns. Just like with Schedule C, lenders will average income for 24 months using two years of filed business (and personal) returns, and if the most recent year is lower, they will average 12 months of the lower year. When it comes to assets, self-employed borrowers sometimes have a lot of their money in their business, and may want to use those funds for down payment. Some lenders will let you do this, and if so, they often require that your tax preparer verifies that use of business funds for a home purchase won’t have a material impact on the business.New rules for self-employed borrowers

In February 2016, Fannie Mae updated self-employment income calculation guidelines for borrowers who own partnerships and S corporations. These guidelines impose stricter analysis on income and debt trends of a company to determine whether the company has sufficient assets to support the withdrawal of earnings to pay its owners. If you own an entity like this, your income from the entity shows up on a form called Schedule K-1. This form is part of the entity’s tax filing, and the figures on this form get carried over to your personal tax return as income. This income most often comes in two main forms: “ordinary business income” and “distributions.” New rules for self-employed borrowers now impose conditions on whether you can use either of these forms of income. For example, if distributions are greater than ordinary business income, then ordinary business income may be used to qualify. But if distributions are less than ordinary business income (or distributions don’t exist), then there are a host of guidelines to determine how you qualify. These guidelines will be specific to your profile and they will vary by lender, so the best way to determine whether you qualify for a loan as a full or part owner of a corporation or partnership is to find a local lender who can analyze your tax returns for you. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.26345 N 88th Way Scottsdale, AZ 85255 | Pinnacle Peak Place Home for Sale – Scottsdale Real Estate

26345 N 88th Way Scottsdale, AZ 85255 has four bedrooms and 3.5 baths inside the main home, the spectacular owners suite boasts a spa like bathroom with free standing soaking tub, walk in shower, dual floating vanities and large walk in closet. The kitchen is artfully designed with sleek European cabinets and Bosch appliances. A granite waterfall island overlooks the family room with bi fold glass doors leading out to custom designed backyard for true indoor/outdoor living. The resort style backyard, concepted by Bianchi Design, is meticulously crafted and the attention to detail of the flawless outdoor space is an extension of the modern aesthetic indoors.

At 26345 N 88th Way Scottsdale, AZ the spectacular 1000 sq foot pool integrates a baja shelf with chaise lounges and water feature that flows into the glass mosaic spa. An outdoor shower, built in BBQ, putting green, bank seating, artificial grass, and outdoor dining area with a custom retractable awning along with sensational views truly make this a one of a kind space built for sensational entertaining. A spacious detached casita with private patio and separate living area compete this phenomenal home.

For more information about this home or other homes in Scottsdale, please contact us at 480.688.2020!

26345 N 88th Way Scottsdale, AZ 85255 has four bedrooms and 3.5 baths inside the main home, the spectacular owners suite boasts a spa like bathroom with free standing soaking tub, walk in shower, dual floating vanities and large walk in closet. The kitchen is artfully designed with sleek European cabinets and Bosch appliances. A granite waterfall island overlooks the family room with bi fold glass doors leading out to custom designed backyard for true indoor/outdoor living. The resort style backyard, concepted by Bianchi Design, is meticulously crafted and the attention to detail of the flawless outdoor space is an extension of the modern aesthetic indoors.

At 26345 N 88th Way Scottsdale, AZ the spectacular 1000 sq foot pool integrates a baja shelf with chaise lounges and water feature that flows into the glass mosaic spa. An outdoor shower, built in BBQ, putting green, bank seating, artificial grass, and outdoor dining area with a custom retractable awning along with sensational views truly make this a one of a kind space built for sensational entertaining. A spacious detached casita with private patio and separate living area compete this phenomenal home.

For more information about this home or other homes in Scottsdale, please contact us at 480.688.2020!

Contact Form

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.

Landscaping Tips to Maximize Curb Appeal By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Other sellers in your area are dressing up the lawn with little flowerbeds and a good trim, but why settle? Follow these five tips to set your home apart from the competition.

By Joe Szabo, Scottsdale Real Estate Team

Other sellers in your area are dressing up the lawn with little flowerbeds and a good trim, but why settle? Follow these five tips to set your home apart from the competition.

Get a competitive edge

Many sellers know that a clean-cut edge can turn even the most mundane lawn into a manicured carpet of green. Set yourself apart and bring a bit of architectural structure to your landscape by installing a brick mowing strip. Not only will this make your lawn look 100 percent nicer, the hard and level boundary between your lawn and landscaping makes subsequent mowings and trimmings a breeze. A less durable, but easier and more cost-effective method, is to create your edge with landscaping timbers that have been staked in place. Plastic edges are the cheapest solution of all, but be warned: They also look cheap, and can even lead buyers to dismiss your home as tacky.Refresh your mailbox

Replacing your mailbox is a classic approach to achieving curb appeal, but why stop there? You’ll already be deep in the trenches with a shovel in hand, so you might as well plant a welcoming mailbox garden to capture potential buyers from their very first glance. When designing your mailbox garden, choose plants that will not become overgrown or require too much upkeep. Dwarf, compact shrubs are good choices because they stay smaller and require less pruning. Groundcovers such as Liriope, daylilies and Agapanthus are useful because they don’t get too tall, and quickly fill in, eventually eliminating the need for mulch. Place taller plants along the back of the bed, and leave a space towards the front where you can plant a fewseasonally appropriate annuals. Just don’t overdo it, since annuals might fizzle out before the house has been sold.Bring beauty to your doorstep

Placing a container garden at your doorstep is a quick and affordable way to liven things up, but since the front door is where the agent pauses to fumble around for a key and discuss the home with her clients, set the tone for that conversation with something bold: Two big stately glazed ceramic pots to each side of the door, each filled with spectacular foliage plants. While flowers seem to scream “Look at me!” in desperation, foliage plants exude grace and confidence. Plant them with something low-maintenance so that they thrive during the stressful move. Choose pots and plants that complement the colors and style of the house: A minimalist planting of snake plant or horsetail in sleek red pots may be appropriate for a mid-century modern home with a red door, but would be out of place on a Victorian porch.Prune the landscape

Notice that I said to prune not just the shrubs, but the entire landscape. It’s common knowledge that you should give your landscape plantings a trim before selling a home, but in the case of so-called ‘trash trees’ and overgrown foundation plantings, those hedge trimmers just aren’t enough. Anything this big should be removed by a professional so that you can focus on the important stuff. Now is also the time to evaluate the effectiveness of your landscape as a whole — not just to you, but everyone else. That vegetable patch or above-ground pool taking up your lawn might be paradise on earth to you and your family, but most prospective buyers will only see weeds and maintenance. However, some features, such as paved paths or patios, can actually bring value to the property because they make life easier without costing much time or effort.Make emotional connections with plants

Cookies in the oven are supposed to make buyers associate your home with their fondest memories, but well-chosen plants turn a house into someone’s home. Fragrant roses, jasmines and herbs will perfume the entry with nostalgia and make your house memorable to buyers. However, avoid placing strong-smelling plants too close to the entry, as this can be off-putting to some. Another trick is to incorporate plants that create a connection to the best features of your property. If it’s a waterfront property in the deep South, use palm trees to frame the view and create a sense of paradise. If the property offers a nice view of a prairie, plant a groundcover of ornamental grasses to connect the yard to the beauty beyond. Don’t skimp on the price either, because the bigger and nicer the plants, the bigger the impact. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.20750 N 87th St #1099 Scottsdale AZ 85255 | Encore at Grayhawk Homes for Sale

20750 N 87th St #1099 has a private Master suite w/surround sound, French door leading to yard, double sinks, closet with built-ins & walk-in shower.Gorgeous backyard with built-in BBQ, above ground built-in spa, tiled patio, view fencing with golf course views!

A SPECTACULAR setting at 20750 N 87th St #1099 for entertaining family and friends or just relax or Dine under the stars with a skyline of city lights. Enjoy all the amenities of The Encore of Grayhawk as well including clubhouse, fitness room & community pool & spa.

20750 N 87th St #1099 has a private Master suite w/surround sound, French door leading to yard, double sinks, closet with built-ins & walk-in shower.Gorgeous backyard with built-in BBQ, above ground built-in spa, tiled patio, view fencing with golf course views!

A SPECTACULAR setting at 20750 N 87th St #1099 for entertaining family and friends or just relax or Dine under the stars with a skyline of city lights. Enjoy all the amenities of The Encore of Grayhawk as well including clubhouse, fitness room & community pool & spa.

Contact Form

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.

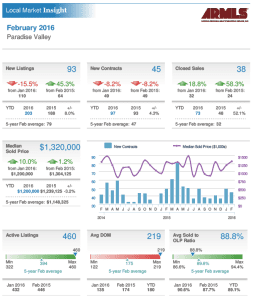

February 2016 Paradise Valley Arizona real estate market update – Arizona Luxury Homes

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at [email protected] or [email protected]. You can also visit https://www.AZLuxuryHomes.com or https://scottsdalerealestateteam.com to find out more about Paradise Valley Homes for Sale and Estates for Sale in Paradise Valley and to search the Paradise Valley MLS for Scottsdale Home Listings.

Please note that this Paradise Valley Real Estate Blog is for informational purposes and not intended to take the place of a licensed Paradise Valley Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale and Paradise Valley Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Paradise Valley, The Szabo group delivers experience, knowledge, dedication and proven results.

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at [email protected] or [email protected]. You can also visit https://www.AZLuxuryHomes.com or https://scottsdalerealestateteam.com to find out more about Paradise Valley Homes for Sale and Estates for Sale in Paradise Valley and to search the Paradise Valley MLS for Scottsdale Home Listings.

Please note that this Paradise Valley Real Estate Blog is for informational purposes and not intended to take the place of a licensed Paradise Valley Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale and Paradise Valley Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Paradise Valley, The Szabo group delivers experience, knowledge, dedication and proven results.The Do’s and Don’ts of Home Equity Loans By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

With home values rising, homeowners who have equity, a much-valued resource, might be tempted to tap some of that wealth and use it for other purposes. But depending on your personal situation and how you’d like to use the equity, it may not necessarily be the right thing to do.

Here’s when a home equity loan, which allows you to use the equity of your home as collateral, makes sense — and when it doesn’t.

By Joe Szabo, Scottsdale Real Estate Team

With home values rising, homeowners who have equity, a much-valued resource, might be tempted to tap some of that wealth and use it for other purposes. But depending on your personal situation and how you’d like to use the equity, it may not necessarily be the right thing to do.

Here’s when a home equity loan, which allows you to use the equity of your home as collateral, makes sense — and when it doesn’t.

DON’T: Fund a lifestyle

Remember a decade ago when homeowners yanked cash out of their homes as if they were bottomless piggy banks to fund affluent lifestyles they couldn’t really afford? These reckless borrowers, with their boats, fancy cars, lavish vacations, and other luxury items, paid the price when the housing bubble burst. Property values plunged, and they lost their homes. Lesson learned: Don’t squander your equity! A home equity loan should be looked at as an “investment,” and not as “extra cash” when making spending decisions.DO: Make home improvements

The safest use of home equity funds is for home improvements that will add to the home’s value. If you have a one-time project (for example, you need a new roof), then a home equity loan might make sense. Need access to money over a period of time to fund ongoing home improvement projects? Then a home equity line of credit (HELOC) would make more sense. HELOCs let you pay as you go, and usually have a variable rate that’s tied to the prime rate, plus or minus some percentage.DON’T: Pay for basic expenses/bills

This is a no-brainer, but it’s always worth reiterating: basic expenses like groceries, clothing, utilities, and phone bills should be a part of your household budget. If your budget doesn’t cover these and you’re thinking of borrowing money to afford them, it’s time to rework your budget and cut some of the excess.DO: Consolidate debt

Consolidating multiple balances, including your high-interest credit card debts, will make perfect sense when you run the numbers — who doesn’t want to save potentially thousands of dollars in interest? Debt consolidation will simplify your life, too, but beware: It only works if you have discipline. If you don’t, you’ll likely run all your balances back up again, and end up in even worse shape.DON’T: Finance college

This may seem like an attractive use of home equity for those with college-age children. However, the potential consequences down the road could be significant. And risky. Remember, tapping into your home equity may mean it takes you longer to pay off the loan. It also may delay your retirement, or put you even deeper in debt. Furthermore, as you get older, it will likely be more difficult to earn the money to pay back the loan. Don’t jeopardize your financial security. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.Selling a Home: Your Legal Checklist By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

If you’re thinking it’s time to sell your home, there are a few legal issues to consider before posting that “For Sale” sign. Whether you are parting ways with your spouse, planning to upgrade or downsize, or selling out of financial necessity, you should protect yourself from pitfalls awaiting the unsavvy seller.

Here are four steps you can take to avoid common issues that pop up during the residential home sale process.

By Joe Szabo, Scottsdale Real Estate Team

If you’re thinking it’s time to sell your home, there are a few legal issues to consider before posting that “For Sale” sign. Whether you are parting ways with your spouse, planning to upgrade or downsize, or selling out of financial necessity, you should protect yourself from pitfalls awaiting the unsavvy seller.

Here are four steps you can take to avoid common issues that pop up during the residential home sale process.

Resolve debts, encumbrances and liens

If your property has incurred any sort of debt, encumbrance or lien, you will need to take care of this prior to settling with your buyer. This obstacle can arise in any number of ways, including through:- Federal, state or local tax liens

- Civil court judgments

- Child support or spousal support missed payments

- General unpaid debts

- Failure to pay homeowners association dues

Get joint tenants on the same page

The ownership structure of your property may impact your ability to sell, especially if you inherited the property with several family members as joint tenants. If this is your situation, your options for selling the property are limited. You can either gather consent from all owners or try to divide the property in your state’s court of equity, which is usually a lengthy, expensive and highly combative process. In other words, before you attempt to sell jointly owned property, you need to get everyone on the same page and agree on how to split the net proceeds after the sale. The same holds true if you and your spouse are going through a divorce and have mutually decided to sell the marital home. If the property was owned through joint tenancy or tenancy by the entirety, both owners will need to sign the transfer deed over to the new buyers and agree to split the proceeds accordingly. Trying to sell the house out from under your ex probably won’t work, and you could face serious fraud consequences for trying it.Draft a home sale agreement, if needed

While other countries have set up laws granting property and ownership rights to unmarried domestic partners, the vast majority of U.S. jurisdictions have yet to catch on to this trend — much to the dismay of domestic partners seeking to sell their home or purchase property. One of the best ways to ensure the process goes smoothly is to encourage open communication and clearly set contract terms that determine the profit division after the sale, especially if one partner is not on the deed. Prior to engaging real estate professionals, sit down with your partner and go over the current financials of the property, including outstanding mortgage debt, asking price and your agreed-upon bottom line offer threshold. From there, discuss the ownership expectations of both parties: Is it 50/50? 40/60? 25/75? This conversation may feel awkward at first, but it is the best way to protect each party’s investment in the property, which includes payment toward the mortgage, improvements, sweat equity and upkeep. Once these issues are decided, have an experienced real estate attorney draft a home sale agreement that sets forth the allocation of proceeds upon sale, the responsibilities of each party with regard to debts or encumbrances, and any other terms agreed upon between you and your partner. With this agreement in place, you are both protected from the pitfalls of litigation in the event the relationship — or the deal — crashes and burns. Otherwise, the court will only be able to help the party named on the deed as the owner.Gather important documents

Finally, as you prepare for the sale of your home, it helps to compile all the important documents related to the value of the property, such as:- Deed

- Evidence of encumbrances, liens, judgments, etc.

- Surveys

- Appraisals

- Documentation of major repairs, damage or improvements

- Any agreements made between tenants or co-habiting partners

- Comparable sales in the area (if available)

- Any agreements made between you as the seller and your real estate agent (if applicable)

- Copies of restrictive covenants imposed upon the community, as this information will be highly relevant to prospective buyers