By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Pros & Cons of Baseboard Heating Systems By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Scottsdale Real Estate and Arizona Luxury Homes brought to you by the Scottsdale Real Estate Team

Search Scottsdale real estate and Paradise Valley real estate, MLS homes and condos for sale. Find the latest market data to help with your property search. Specializing in luxury homes, golf properties, condos and more.

February 10, 2014 Joe Szabo

By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

February 6, 2014 Joe Szabo

February 4, 2014 Joe Szabo

*The weekly mortgage rate chart illustrates the average 30-year fixed interest in six-hour intervals.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

*The weekly mortgage rate chart illustrates the average 30-year fixed interest in six-hour intervals.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

January 30, 2014 Joe Szabo

By Joe Szabo, Scottsdale Real Estate Team

From Bing Crosby to Beyoncé, Scottsdale and Paradise Valley have been popular stomping grounds for Hollywood headliners since the 1940s.

Its proximity to Los Angeles – and reputation as a desert South Beach – have drawn hundreds of stars through the years to hideaways such as Hotel Valley Ho, Fairmont Scottsdale Princess, Sanctuary on Camelback Mountain and the Hermosa Inn.

According to the Scottsdale Convention and Visitor’s Bureau, stars are attracted to Scottsdale “for rest and relaxation, far from the prying lenses of the paparazzi and congested streets of Los Angeles and New York City.”

See who lives where here

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

By Joe Szabo, Scottsdale Real Estate Team

From Bing Crosby to Beyoncé, Scottsdale and Paradise Valley have been popular stomping grounds for Hollywood headliners since the 1940s.

Its proximity to Los Angeles – and reputation as a desert South Beach – have drawn hundreds of stars through the years to hideaways such as Hotel Valley Ho, Fairmont Scottsdale Princess, Sanctuary on Camelback Mountain and the Hermosa Inn.

According to the Scottsdale Convention and Visitor’s Bureau, stars are attracted to Scottsdale “for rest and relaxation, far from the prying lenses of the paparazzi and congested streets of Los Angeles and New York City.”

See who lives where here

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.January 27, 2014 Joe Szabo

worry out of applying for a home loan, but it will go a long way toward reducing your anxiety.

Here are key factors lenders may consider when reviewing your mortgage application.

worry out of applying for a home loan, but it will go a long way toward reducing your anxiety.

Here are key factors lenders may consider when reviewing your mortgage application.

January 23, 2014 Joe Szabo

By Joe Szabo, Scottsdale Real Estate Team

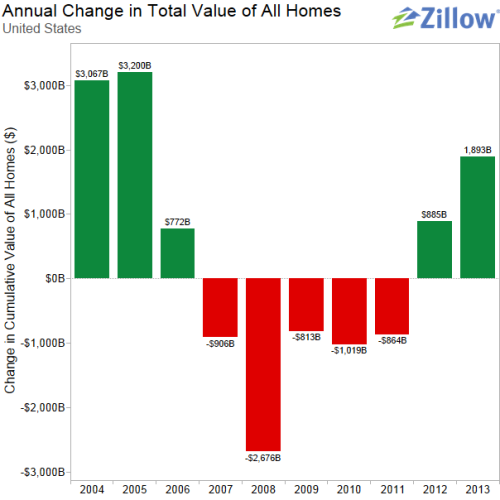

If you wanted to buy every single home in the country, all at once, you’d need to be prepared to spend more than $25 trillion, according to Zillow.

The overall cumulative value of all homes in the U.S. at the end of 2013 is expected to be approximately $25.7 trillion, up almost $1.9 trillion, or 7.9 percent, from the end of 2012. Gains were calculated by measuring the difference between cumulative home values as of the end of 2012 and anticipated cumulative home values at the end of 2013.

The gain in cumulative home values is the second annual gain in a row, after home values fell every year from 2007 through 2011. Between 2007 and 2011, the total value of the U.S. housing stock fell by $6.3 trillion. Over the past two years, U.S. homes have gained back $2.8 trillion, or about 44 percent of the total value lost during the recession.

“In 2013, the housing market continued to build on the positive momentum that began in 2012, after the housing market bottomed. Low mortgage rates and an improving economy helped bring buyers into the market, boosting demand and driving prices up,” said Zillow Chief Economist Stan Humphries. “We expect these gains to continue into next year, though at a slower pace. The housing market is transitioning away from the robust bounce off the bottom we’ve been seeing, toward a more sustainable, healthier market. This will result in annual appreciation closer to historic norms of between 3 percent and 5 percent.”

Real estate in the United States is hugely valuable. The $25.7 trillion total value of the country’s entire housing stock is more than the combined gross domestic products (GDP) of China and the U.S. in 2012. Homes in the New York and Los Angeles markets alone account for more than $4 trillion in combined value.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

By Joe Szabo, Scottsdale Real Estate Team

If you wanted to buy every single home in the country, all at once, you’d need to be prepared to spend more than $25 trillion, according to Zillow.

The overall cumulative value of all homes in the U.S. at the end of 2013 is expected to be approximately $25.7 trillion, up almost $1.9 trillion, or 7.9 percent, from the end of 2012. Gains were calculated by measuring the difference between cumulative home values as of the end of 2012 and anticipated cumulative home values at the end of 2013.

The gain in cumulative home values is the second annual gain in a row, after home values fell every year from 2007 through 2011. Between 2007 and 2011, the total value of the U.S. housing stock fell by $6.3 trillion. Over the past two years, U.S. homes have gained back $2.8 trillion, or about 44 percent of the total value lost during the recession.

“In 2013, the housing market continued to build on the positive momentum that began in 2012, after the housing market bottomed. Low mortgage rates and an improving economy helped bring buyers into the market, boosting demand and driving prices up,” said Zillow Chief Economist Stan Humphries. “We expect these gains to continue into next year, though at a slower pace. The housing market is transitioning away from the robust bounce off the bottom we’ve been seeing, toward a more sustainable, healthier market. This will result in annual appreciation closer to historic norms of between 3 percent and 5 percent.”

Real estate in the United States is hugely valuable. The $25.7 trillion total value of the country’s entire housing stock is more than the combined gross domestic products (GDP) of China and the U.S. in 2012. Homes in the New York and Los Angeles markets alone account for more than $4 trillion in combined value.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.January 20, 2014 Joe Szabo

By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Kitchens have become the center of many American homes — the place that sees the most foot traffic and activity. According to the latest Zillow Digs designer survey, kitchens top the list for planned 2014 renovations.

Kitchens in 2014 are trending toward open, “homey” spaces, says designer Vanessa DeLeon. “More and more people are wanting an ‘open concept’ space and the feeling of comfort,” she explained. “They want to be able to eat, entertain, relax and enjoy the space with the rest of the house.” Considering a kitchen remodel? Start researching contractors or designers. “Ask people you trust for referrals for general contractors they’ve successfully worked with,” Klebanoff said. “Set up interviews with them and present your now very clearly defined project to them for bids. Check their references!” Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.January 16, 2014 Joe Szabo

By Joe Szabo, Scottsdale Real Estate Team

Mortgage rates were unchanged to just slightly higher to begin the holiday-shortened week. With the exception of last Thursday, rates are the highest they’ve been in more than three months. The most prevalently quoted rate for ideal, conforming 30yr Fixed loans remains 4.625% (best-execution).

Market conditions were exceptionally calm today, and there’s a good chance that will continue as the holidays keep market participants away. Most lenders will release rate sheets as normal tomorrow, but bond markets, including the secondary mortgage market, will close 3 hours earlier than normal and remain closed all day Wednesday. In general, lenders tend to be more conservative with rates during this time of year.

“Conservative” in this case, means “less likely to change rate sheets in the middle of the day” and “wanting to see more market improvement than normal before offering lower rates.” The current scenario is compounded by uncertainty over the latest round of fee increases for Fannie/Freddie loans.

The fee increases pertain to the Guarantee Fees (or “G-fees”) charged by Fannie and Freddie in order to guarantee the repayment of mortgages. G-fees are a regular feature in Fannie/Freddie loans and they’ve been steadily rising since 2010. The announcement of an increase of 0.10% on December 9th was no surprise.

But there are two components to G-fees–the permanent (or “ongoing”) 0.10% mentioned above which affects all similar loans equally, and the upfront G-fees which depend on credit quality (also known as Loan Level Price Adjustments or LLPA’s). The same announcement that raised the ongoing G-fee by 0.10% also served as notification that Fannie and Freddie would soon release updated LLPA’s. They did this last week and the implication was fairly alarming for rates in the first quarter of 2014.

Late Friday, incoming FHFA Director (that’s who oversees Fannie/Freddie) Mel Watt said in an email that he would freeze the fee hikes until he had an opportunity to review the rationale for the decision and the impact on the housing market. This would be on January 6th, but some lenders have already begun pricing in the effects from the fee hikes for certain loans. It’s as yet unclear if borrowers who lock now based on the higher fees would receive the more favorable terms if the fee hike is indeed frozen. When in doubt, be sure to ask your lender if you’re locking a loan between now and then.

Loan Originator Perspectives

“Slow day in MBS Land as expected this Christmas week. Some minimal losses from Friday’s close impacted pricing, but only slightly. Biggest and best present for all involved in housing industry is Mel Watt’s announcement late Friday that he intends to delay or revise increased agency fees that were slated to raise rates/costs for all borrowers as early as January. We’ll keep our eyes open for updates on this critical issue. In the meantime, hope all have a blessed holiday!” -Ted Rood, Senior Originator, Wintrust Mortgage

“Slow week so not much to focus on. Another early Christmas present from incoming FHFA chief, Mel Watt in the form of delayed LLPAs. Fees that were to kick in almost immediately are now delayed pending his review of the rationale. If he’s rational then they will be tabled forever. I think we have a good chance this will be the end result considering he made this decision before he was even sworn in. Thanks Mel on behalf of mortgage originators and future and current homeowners everywhere.” -Mike Owens, VP of Mortgage Lending Guaranteed Rate, Inc.

Today’s Best-Execution Rates

By Joe Szabo, Scottsdale Real Estate Team

Mortgage rates were unchanged to just slightly higher to begin the holiday-shortened week. With the exception of last Thursday, rates are the highest they’ve been in more than three months. The most prevalently quoted rate for ideal, conforming 30yr Fixed loans remains 4.625% (best-execution).

Market conditions were exceptionally calm today, and there’s a good chance that will continue as the holidays keep market participants away. Most lenders will release rate sheets as normal tomorrow, but bond markets, including the secondary mortgage market, will close 3 hours earlier than normal and remain closed all day Wednesday. In general, lenders tend to be more conservative with rates during this time of year.

“Conservative” in this case, means “less likely to change rate sheets in the middle of the day” and “wanting to see more market improvement than normal before offering lower rates.” The current scenario is compounded by uncertainty over the latest round of fee increases for Fannie/Freddie loans.

The fee increases pertain to the Guarantee Fees (or “G-fees”) charged by Fannie and Freddie in order to guarantee the repayment of mortgages. G-fees are a regular feature in Fannie/Freddie loans and they’ve been steadily rising since 2010. The announcement of an increase of 0.10% on December 9th was no surprise.

But there are two components to G-fees–the permanent (or “ongoing”) 0.10% mentioned above which affects all similar loans equally, and the upfront G-fees which depend on credit quality (also known as Loan Level Price Adjustments or LLPA’s). The same announcement that raised the ongoing G-fee by 0.10% also served as notification that Fannie and Freddie would soon release updated LLPA’s. They did this last week and the implication was fairly alarming for rates in the first quarter of 2014.

Late Friday, incoming FHFA Director (that’s who oversees Fannie/Freddie) Mel Watt said in an email that he would freeze the fee hikes until he had an opportunity to review the rationale for the decision and the impact on the housing market. This would be on January 6th, but some lenders have already begun pricing in the effects from the fee hikes for certain loans. It’s as yet unclear if borrowers who lock now based on the higher fees would receive the more favorable terms if the fee hike is indeed frozen. When in doubt, be sure to ask your lender if you’re locking a loan between now and then.

Loan Originator Perspectives

“Slow day in MBS Land as expected this Christmas week. Some minimal losses from Friday’s close impacted pricing, but only slightly. Biggest and best present for all involved in housing industry is Mel Watt’s announcement late Friday that he intends to delay or revise increased agency fees that were slated to raise rates/costs for all borrowers as early as January. We’ll keep our eyes open for updates on this critical issue. In the meantime, hope all have a blessed holiday!” -Ted Rood, Senior Originator, Wintrust Mortgage

“Slow week so not much to focus on. Another early Christmas present from incoming FHFA chief, Mel Watt in the form of delayed LLPAs. Fees that were to kick in almost immediately are now delayed pending his review of the rationale. If he’s rational then they will be tabled forever. I think we have a good chance this will be the end result considering he made this decision before he was even sworn in. Thanks Mel on behalf of mortgage originators and future and current homeowners everywhere.” -Mike Owens, VP of Mortgage Lending Guaranteed Rate, Inc.

Today’s Best-Execution Rates

January 10, 2014 Joe Szabo

By Joe Szabo, Scottsdale Real Estate Team

Do you know what niche has a demand so large that it could someday account for up to 35 percent of all sales? You may be surprised to learn that niche is new construction.

Laurence Yun, chief economist for the National Association of Realtors, predicts that in 2014 there will be approximately 5.1 million home sales. This is about the same pace as 2013. While new-home sales had a 25 percent increase from 2012 (from 400,000 to 500,000), they still accounted for less than 10 percent of the total sales in 2013.

Demand is outpacing new-home construction

Yun predicted that while housing starts will increase by 25 percent to about 625,000 in 2014, to keep pace with the demand, new-home starts would have to increase by another 50-60 percent. A Harvard study estimates the shortfall to be approximately 1.8 million new homes per year.

Majority of buyers would consider buying new construction

A builder consortium that included 32 builders across 25 markets found that 54 percent of the buyers surveyed said they would consider purchasing new construction. A sales pace of 5.1 million units translates into 2.75 million home purchasers who would like to consider new construction as part of their home search. Given that there will be only 625,000 actual new units built, the potential shortfall could be more than 2 million new homes. What can you do to capitalize on this opportunity?

1. New-home sales drive resales

The National Association of Home Builders reports that 70 percent of their buyers have an existing home to sell. The agents who represent builders seldom take outside listings. This means that if you represent new-home purchasers, you have a very high probability of listing their home as well.

A second opportunity occurs when the builder has sold out most of its inventory. In many cases, the builders close down their sales office and then list the final one or two properties with an outside agent. If you have been actively showing and selling that builder’s product, there’s a good chance you may obtain that listing as well.

2. Infill: the real opportunity

While many agents would like to represent the big builders, most fail to realize that the greatest opportunity may be with small builders. While it takes special training to represent a large builder, which often includes being able to lay out changes to blueprints, the real opportunity for most agents is with “infill.”

The term “infill” refers to creating new construction in areas that are already built out. This opportunity is greatest in major metropolitan areas. In fact, the prediction from NAR’s new-home panel was that by the end of 2014, 30 percent of all new construction would be due to “infill” properties. These smaller projects are usually of no interest to big-name builders and also fly under the radar of most real estate agents.

One of my former real estate partners in Los Angeles capitalized on this approach by working with several different condominium developers. Sometimes the builder found the property, or my partner located it. Prime targets for acquisition might be three houses on adjoining lots with zoning that would allow for six to 12 units on the property. Other times, the opportunity might be with two adjoining fourplexes where the property could be zoned for 20-24 condos.

This agent not only sold the units, she also obtained listings on what the buyers had to sell. Even after the project was sold out, she continued to be the listing agent of choice for her past buyers when they decided to move.

You can take advantage of this opportunity by becoming an active member in your area’s local builders association. Familiarize yourself with the zoning laws, environmental requirements, absorption rates, and the spread between the property’s current value vs. what it could bring once it’s replaced with new construction.

Your goal is to make yourself the indispensable expert. Help the builders you meet keep abreast of what is occurring in the market, where it is trending, as well as how quickly their project may sell once they complete construction nine to 24 months from now.

3. Single-family opportunities

An entirely different option is to locate foreclosures or dilapidated properties that can be acquired for lot value, torn down, and then replaced with new construction. This is an especially good option in many luxury markets, since most of these areas are already built out.

The beauty of working with a smaller builder is that you obtain a commission on the land sale and on the listing side once the property is built out, as well as possibly selling it to a buyer who has another property to sell. That’s a total of four commissions!

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

By Joe Szabo, Scottsdale Real Estate Team

Do you know what niche has a demand so large that it could someday account for up to 35 percent of all sales? You may be surprised to learn that niche is new construction.

Laurence Yun, chief economist for the National Association of Realtors, predicts that in 2014 there will be approximately 5.1 million home sales. This is about the same pace as 2013. While new-home sales had a 25 percent increase from 2012 (from 400,000 to 500,000), they still accounted for less than 10 percent of the total sales in 2013.

Demand is outpacing new-home construction

Yun predicted that while housing starts will increase by 25 percent to about 625,000 in 2014, to keep pace with the demand, new-home starts would have to increase by another 50-60 percent. A Harvard study estimates the shortfall to be approximately 1.8 million new homes per year.

Majority of buyers would consider buying new construction

A builder consortium that included 32 builders across 25 markets found that 54 percent of the buyers surveyed said they would consider purchasing new construction. A sales pace of 5.1 million units translates into 2.75 million home purchasers who would like to consider new construction as part of their home search. Given that there will be only 625,000 actual new units built, the potential shortfall could be more than 2 million new homes. What can you do to capitalize on this opportunity?

1. New-home sales drive resales

The National Association of Home Builders reports that 70 percent of their buyers have an existing home to sell. The agents who represent builders seldom take outside listings. This means that if you represent new-home purchasers, you have a very high probability of listing their home as well.

A second opportunity occurs when the builder has sold out most of its inventory. In many cases, the builders close down their sales office and then list the final one or two properties with an outside agent. If you have been actively showing and selling that builder’s product, there’s a good chance you may obtain that listing as well.

2. Infill: the real opportunity

While many agents would like to represent the big builders, most fail to realize that the greatest opportunity may be with small builders. While it takes special training to represent a large builder, which often includes being able to lay out changes to blueprints, the real opportunity for most agents is with “infill.”

The term “infill” refers to creating new construction in areas that are already built out. This opportunity is greatest in major metropolitan areas. In fact, the prediction from NAR’s new-home panel was that by the end of 2014, 30 percent of all new construction would be due to “infill” properties. These smaller projects are usually of no interest to big-name builders and also fly under the radar of most real estate agents.

One of my former real estate partners in Los Angeles capitalized on this approach by working with several different condominium developers. Sometimes the builder found the property, or my partner located it. Prime targets for acquisition might be three houses on adjoining lots with zoning that would allow for six to 12 units on the property. Other times, the opportunity might be with two adjoining fourplexes where the property could be zoned for 20-24 condos.

This agent not only sold the units, she also obtained listings on what the buyers had to sell. Even after the project was sold out, she continued to be the listing agent of choice for her past buyers when they decided to move.

You can take advantage of this opportunity by becoming an active member in your area’s local builders association. Familiarize yourself with the zoning laws, environmental requirements, absorption rates, and the spread between the property’s current value vs. what it could bring once it’s replaced with new construction.

Your goal is to make yourself the indispensable expert. Help the builders you meet keep abreast of what is occurring in the market, where it is trending, as well as how quickly their project may sell once they complete construction nine to 24 months from now.

3. Single-family opportunities

An entirely different option is to locate foreclosures or dilapidated properties that can be acquired for lot value, torn down, and then replaced with new construction. This is an especially good option in many luxury markets, since most of these areas are already built out.

The beauty of working with a smaller builder is that you obtain a commission on the land sale and on the listing side once the property is built out, as well as possibly selling it to a buyer who has another property to sell. That’s a total of four commissions!

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.January 7, 2014 Joe Szabo

Resale Value

Buying a slightly larger house with one more bedroom means that the home will be easier to sell in the future. This is especially true if all of the other homes in the area have similar amounts of bedrooms. Buyers these days want more rooms and an added bedroom gives them options that could be the deciding factor between yours and the home down the street.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

Resale Value

Buying a slightly larger house with one more bedroom means that the home will be easier to sell in the future. This is especially true if all of the other homes in the area have similar amounts of bedrooms. Buyers these days want more rooms and an added bedroom gives them options that could be the deciding factor between yours and the home down the street.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

Mobile: 480-688-2020

Office: 480-889-8702

Fax: 480-355-9444

[email protected]

21000 N. Pima Rd

Suite 100

Scottsdale AZ, 85255

to save your favourite homes and more

Log in with emailDon't have an account? Sign up

Enter your email address and we will send you a link to change your password.

to save your favourite homes and more

Sign up with emailAlready have an account? Log in