Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at [email protected] or [email protected]. You can also visit https://www.AZLuxuryHomes.com or https://scottsdalerealestateteam.com to find out more about Paradise Valley Homes for Sale and Estates for Sale in Paradise Valley and to search the Paradise Valley MLS for Scottsdale Home Listings.

Please note that this Paradise Valley Real Estate Blog is for informational purposes and not intended to take the place of a licensed Paradise Valley Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale and Paradise Valley Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Paradise Valley, The Szabo group delivers experience, knowledge, dedication and proven results.

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at [email protected] or [email protected]. You can also visit https://www.AZLuxuryHomes.com or https://scottsdalerealestateteam.com to find out more about Paradise Valley Homes for Sale and Estates for Sale in Paradise Valley and to search the Paradise Valley MLS for Scottsdale Home Listings.

Please note that this Paradise Valley Real Estate Blog is for informational purposes and not intended to take the place of a licensed Paradise Valley Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale and Paradise Valley Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Paradise Valley, The Szabo group delivers experience, knowledge, dedication and proven results.

By

By  By

By

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

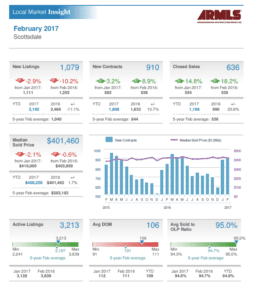

Can you believe it’s already March? The Valley is swarming with snowbirds and sports fans and with all of the poor weather conditions around the country more and more people seem to be eyeing Scottsdale as a possible new home. Let’s take a look at how the Scottsdale real estate market fared in February. New listings are down 2.9% from January with a total of 1,079 new listings vs. 1,111 in January. The new listings in January were driven by homeowners waiting until after the holidays to list their home; it is typical for February numbers to be lower than January for this reason. New contracts and closed sales were both up in February by 3.2% and 14.8% respectively. The median sale is down from $410,000 in January to $401,460 in February. February closed with some motivating numbers – Sellers on the fence are strongly encouraged to take advantage of the low inventory and high demand! During these up and down activity months it is more important than ever to consult a real estate professional that knows the Scottsdale market.

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Can you believe it’s already March? The Valley is swarming with snowbirds and sports fans and with all of the poor weather conditions around the country more and more people seem to be eyeing Scottsdale as a possible new home. Let’s take a look at how the Scottsdale real estate market fared in February. New listings are down 2.9% from January with a total of 1,079 new listings vs. 1,111 in January. The new listings in January were driven by homeowners waiting until after the holidays to list their home; it is typical for February numbers to be lower than January for this reason. New contracts and closed sales were both up in February by 3.2% and 14.8% respectively. The median sale is down from $410,000 in January to $401,460 in February. February closed with some motivating numbers – Sellers on the fence are strongly encouraged to take advantage of the low inventory and high demand! During these up and down activity months it is more important than ever to consult a real estate professional that knows the Scottsdale market.

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at  By

By  The low supply of homes on the market has pushed the ideal window later in the spring. Many shoppers who start searching for a home in early spring may need to look at several homes and make multiple offers, and may still be shopping a few months later.

By May, some buyers will be anxious to avoid more disappointment or eager to get settled into a new home before the next school year — and will be more willing to pay a premium to close the deal.

The May sales boost was particularly notable in Seattle and Portland where sellers who listed in the first half of the month stand to gain the biggest price boost — 2.5 percent in Seattle, 2 percent in Portland — over the area’s average.

On the other end, typically warm weather regions like Miami, Tampa and Phoenix tend show very little variation in sales price or time on market based on listing months. Sellers in these markets will find themselves with more flexibility in choosing when to sell their home.

To apply this analysis to their own home, sellers can use Zillow’s Best Time to List tool to estimate how much listing timing will influence the final sale price in their neighborhood. Registered Zillow users access the tool by clicking the “Sell Your Home” tab on the home details page of their home, and obtain valuable information to pair with the expertise of a local real estate agent when determining the best time to put their home on the market.

The low supply of homes on the market has pushed the ideal window later in the spring. Many shoppers who start searching for a home in early spring may need to look at several homes and make multiple offers, and may still be shopping a few months later.

By May, some buyers will be anxious to avoid more disappointment or eager to get settled into a new home before the next school year — and will be more willing to pay a premium to close the deal.

The May sales boost was particularly notable in Seattle and Portland where sellers who listed in the first half of the month stand to gain the biggest price boost — 2.5 percent in Seattle, 2 percent in Portland — over the area’s average.

On the other end, typically warm weather regions like Miami, Tampa and Phoenix tend show very little variation in sales price or time on market based on listing months. Sellers in these markets will find themselves with more flexibility in choosing when to sell their home.

To apply this analysis to their own home, sellers can use Zillow’s Best Time to List tool to estimate how much listing timing will influence the final sale price in their neighborhood. Registered Zillow users access the tool by clicking the “Sell Your Home” tab on the home details page of their home, and obtain valuable information to pair with the expertise of a local real estate agent when determining the best time to put their home on the market.

By

By  By

By

If you’re considering to purchase or sell a property in Scottsdale we invite you to reach out to Joe and Linda Szabo with The Szabo Group – The Scottsdale Real Estate Experts! They and their team are more than happy to assist you with any of your real estate needs.

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

If you’re considering to purchase or sell a property in Scottsdale we invite you to reach out to Joe and Linda Szabo with The Szabo Group – The Scottsdale Real Estate Experts! They and their team are more than happy to assist you with any of your real estate needs.

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

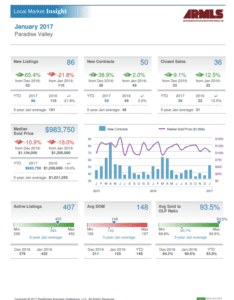

Can you believe it’s already February? Let’s take a look at how the Paradise Valley real estate market faired in January. New listings are up by 65.4% from December with a total of 86 new listings vs. 52 in December. The new listings in January were driven by homeowners waiting until after the holidays to list their home. New contracts were up in January by 38.9% with 50 new listings and closed sales went up with January numbers at 36 closed sales vs. 33 in December. The median sale is down from $1,104,000 in December to $983,750 in January. January closed with some motivating numbers – Sellers on the fence are strongly encouraged to take advantage of the low inventory and high demand! . During these up and down activity months it is more important than ever to consult a real estate professional that knows the Paradise Valley market.

If you’re considering to purchase or sell a property in Scottsdale we invite you to reach out to Joe and Linda Szabo with The Szabo Group – The Scottsdale Real Estate Experts! They and their team are more than happy to assist you with any of your real estate needs.

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Can you believe it’s already February? Let’s take a look at how the Paradise Valley real estate market faired in January. New listings are up by 65.4% from December with a total of 86 new listings vs. 52 in December. The new listings in January were driven by homeowners waiting until after the holidays to list their home. New contracts were up in January by 38.9% with 50 new listings and closed sales went up with January numbers at 36 closed sales vs. 33 in December. The median sale is down from $1,104,000 in December to $983,750 in January. January closed with some motivating numbers – Sellers on the fence are strongly encouraged to take advantage of the low inventory and high demand! . During these up and down activity months it is more important than ever to consult a real estate professional that knows the Paradise Valley market.

If you’re considering to purchase or sell a property in Scottsdale we invite you to reach out to Joe and Linda Szabo with The Szabo Group – The Scottsdale Real Estate Experts! They and their team are more than happy to assist you with any of your real estate needs.

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at