By Joe Szabo, Scottsdale Real Estate Team

Now that the summer season is in full swing, it’s time to turn your attention to your vacation home. Whether you’re perched on a tropical beach or kicking back surrounded by mountains, all vacation homes require a relaxing ambiance. Good news: It can be achieved by decorating with our easy-to-follow steps below.

So sit back, pour yourself a summertime cocktail, and take notes on how you can better decorate your vacation home for yourself and your guests.

By Joe Szabo, Scottsdale Real Estate Team

Now that the summer season is in full swing, it’s time to turn your attention to your vacation home. Whether you’re perched on a tropical beach or kicking back surrounded by mountains, all vacation homes require a relaxing ambiance. Good news: It can be achieved by decorating with our easy-to-follow steps below.

So sit back, pour yourself a summertime cocktail, and take notes on how you can better decorate your vacation home for yourself and your guests.

Decorating Your Vacation Home By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Now that the summer season is in full swing, it’s time to turn your attention to your vacation home. Whether you’re perched on a tropical beach or kicking back surrounded by mountains, all vacation homes require a relaxing ambiance. Good news: It can be achieved by decorating with our easy-to-follow steps below.

So sit back, pour yourself a summertime cocktail, and take notes on how you can better decorate your vacation home for yourself and your guests.

By Joe Szabo, Scottsdale Real Estate Team

Now that the summer season is in full swing, it’s time to turn your attention to your vacation home. Whether you’re perched on a tropical beach or kicking back surrounded by mountains, all vacation homes require a relaxing ambiance. Good news: It can be achieved by decorating with our easy-to-follow steps below.

So sit back, pour yourself a summertime cocktail, and take notes on how you can better decorate your vacation home for yourself and your guests.

By

By  By

By  By

By  By

By

20750 N 87th St #1099 has a private Master suite w/surround sound, French door leading to yard, double sinks, closet with built-ins & walk-in shower.Gorgeous backyard with built-in BBQ, above ground built-in spa, tiled patio, view fencing with golf course views!

A SPECTACULAR setting at 20750 N 87th St #1099 for entertaining family and friends or just relax or Dine under the stars with a skyline of city lights. Enjoy all the amenities of The Encore of Grayhawk as well including clubhouse, fitness room & community pool & spa.

20750 N 87th St #1099 has a private Master suite w/surround sound, French door leading to yard, double sinks, closet with built-ins & walk-in shower.Gorgeous backyard with built-in BBQ, above ground built-in spa, tiled patio, view fencing with golf course views!

A SPECTACULAR setting at 20750 N 87th St #1099 for entertaining family and friends or just relax or Dine under the stars with a skyline of city lights. Enjoy all the amenities of The Encore of Grayhawk as well including clubhouse, fitness room & community pool & spa.

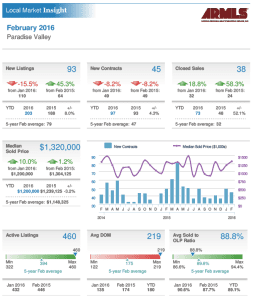

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

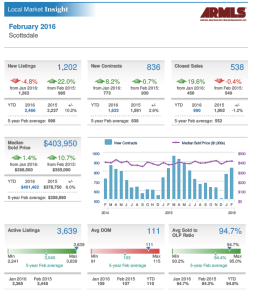

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at  By

By