We at Scottdale Real Estate Team off your best wishes for a wonderful holiday season and a new year filled with peace, prosperity and happiness. Happy holidays and a very happy 2018!

We at Scottdale Real Estate Team off your best wishes for a wonderful holiday season and a new year filled with peace, prosperity and happiness. Happy holidays and a very happy 2018!

New Mortgage Rules For Self-Employed Borrowers By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

If you’re self-employed, you must meet different requirements than a salaried person to qualify for a mortgage. The rules about how that works were updated in recent months to take an even closer look at your business income, so let’s review the rules for self-employed people borrowing for the first time, and for those who will be impacted by new rules next time they get a loan.

By Joe Szabo, Scottsdale Real Estate Team

If you’re self-employed, you must meet different requirements than a salaried person to qualify for a mortgage. The rules about how that works were updated in recent months to take an even closer look at your business income, so let’s review the rules for self-employed people borrowing for the first time, and for those who will be impacted by new rules next time they get a loan.

Self-employed borrower basics

Two of the most important things lenders review to qualify you for a mortgage are income and assets, which respectively, determine how much monthly payment you can afford and where your down payment is coming from. When it comes to income, self-employed borrowers report income as sole proprietors or owners of entities like corporations, partnerships, or limited liability companies (LLCs). As a sole proprietor, you will file your self-employed income on IRS Schedule C, which tracks your income and expenses for a given year. Unlike with salaried employees, who get to use their gross income for loan qualifying, sole proprietor borrowers must qualify using their net income from Schedule C. Furthermore, lenders calculate a 24-month average of net income for sole proprietors (as opposed to sometimes requiring just one year from salaried borrowers), and if the most recent Schedule C has lower net income than the previous year, lenders will use worst-case income by calculating a 12-month average of the most recent year. If you’re self-employed and conduct business via a corporation, partnership, or LLC, the IRS requires these entities to file separate sets of tax returns. If you own 25 percent or more of the entity, you will need to provide lenders with these full business tax returns, as well as your personal returns. Just like with Schedule C, lenders will average income for 24 months using two years of filed business (and personal) returns, and if the most recent year is lower, they will average 12 months of the lower year. When it comes to assets, self-employed borrowers sometimes have a lot of their money in their business, and may want to use those funds for down payment. Some lenders will let you do this, and if so, they often require that your tax preparer verifies that use of business funds for a home purchase won’t have a material impact on the business.New rules for self-employed borrowers

In February 2016, Fannie Mae updated self-employment income calculation guidelines for borrowers who own partnerships and S corporations. These guidelines impose stricter analysis on income and debt trends of a company to determine whether the company has sufficient assets to support the withdrawal of earnings to pay its owners. If you own an entity like this, your income from the entity shows up on a form called Schedule K-1. This form is part of the entity’s tax filing, and the figures on this form get carried over to your personal tax return as income. This income most often comes in two main forms: “ordinary business income” and “distributions.” New rules for self-employed borrowers now impose conditions on whether you can use either of these forms of income. For example, if distributions are greater than ordinary business income, then ordinary business income may be used to qualify. But if distributions are less than ordinary business income (or distributions don’t exist), then there are a host of guidelines to determine how you qualify. These guidelines will be specific to your profile and they will vary by lender, so the best way to determine whether you qualify for a loan as a full or part owner of a corporation or partnership is to find a local lender who can analyze your tax returns for you. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.26345 N 88th Way Scottsdale, AZ 85255 | Pinnacle Peak Place Home for Sale – Scottsdale Real Estate

26345 N 88th Way Scottsdale, AZ 85255 has four bedrooms and 3.5 baths inside the main home, the spectacular owners suite boasts a spa like bathroom with free standing soaking tub, walk in shower, dual floating vanities and large walk in closet. The kitchen is artfully designed with sleek European cabinets and Bosch appliances. A granite waterfall island overlooks the family room with bi fold glass doors leading out to custom designed backyard for true indoor/outdoor living. The resort style backyard, concepted by Bianchi Design, is meticulously crafted and the attention to detail of the flawless outdoor space is an extension of the modern aesthetic indoors.

At 26345 N 88th Way Scottsdale, AZ the spectacular 1000 sq foot pool integrates a baja shelf with chaise lounges and water feature that flows into the glass mosaic spa. An outdoor shower, built in BBQ, putting green, bank seating, artificial grass, and outdoor dining area with a custom retractable awning along with sensational views truly make this a one of a kind space built for sensational entertaining. A spacious detached casita with private patio and separate living area compete this phenomenal home.

For more information about this home or other homes in Scottsdale, please contact us at 480.688.2020!

26345 N 88th Way Scottsdale, AZ 85255 has four bedrooms and 3.5 baths inside the main home, the spectacular owners suite boasts a spa like bathroom with free standing soaking tub, walk in shower, dual floating vanities and large walk in closet. The kitchen is artfully designed with sleek European cabinets and Bosch appliances. A granite waterfall island overlooks the family room with bi fold glass doors leading out to custom designed backyard for true indoor/outdoor living. The resort style backyard, concepted by Bianchi Design, is meticulously crafted and the attention to detail of the flawless outdoor space is an extension of the modern aesthetic indoors.

At 26345 N 88th Way Scottsdale, AZ the spectacular 1000 sq foot pool integrates a baja shelf with chaise lounges and water feature that flows into the glass mosaic spa. An outdoor shower, built in BBQ, putting green, bank seating, artificial grass, and outdoor dining area with a custom retractable awning along with sensational views truly make this a one of a kind space built for sensational entertaining. A spacious detached casita with private patio and separate living area compete this phenomenal home.

For more information about this home or other homes in Scottsdale, please contact us at 480.688.2020!

Contact Form

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.

Landscaping Tips to Maximize Curb Appeal By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Other sellers in your area are dressing up the lawn with little flowerbeds and a good trim, but why settle? Follow these five tips to set your home apart from the competition.

By Joe Szabo, Scottsdale Real Estate Team

Other sellers in your area are dressing up the lawn with little flowerbeds and a good trim, but why settle? Follow these five tips to set your home apart from the competition.

Get a competitive edge

Many sellers know that a clean-cut edge can turn even the most mundane lawn into a manicured carpet of green. Set yourself apart and bring a bit of architectural structure to your landscape by installing a brick mowing strip. Not only will this make your lawn look 100 percent nicer, the hard and level boundary between your lawn and landscaping makes subsequent mowings and trimmings a breeze. A less durable, but easier and more cost-effective method, is to create your edge with landscaping timbers that have been staked in place. Plastic edges are the cheapest solution of all, but be warned: They also look cheap, and can even lead buyers to dismiss your home as tacky.Refresh your mailbox

Replacing your mailbox is a classic approach to achieving curb appeal, but why stop there? You’ll already be deep in the trenches with a shovel in hand, so you might as well plant a welcoming mailbox garden to capture potential buyers from their very first glance. When designing your mailbox garden, choose plants that will not become overgrown or require too much upkeep. Dwarf, compact shrubs are good choices because they stay smaller and require less pruning. Groundcovers such as Liriope, daylilies and Agapanthus are useful because they don’t get too tall, and quickly fill in, eventually eliminating the need for mulch. Place taller plants along the back of the bed, and leave a space towards the front where you can plant a fewseasonally appropriate annuals. Just don’t overdo it, since annuals might fizzle out before the house has been sold.Bring beauty to your doorstep

Placing a container garden at your doorstep is a quick and affordable way to liven things up, but since the front door is where the agent pauses to fumble around for a key and discuss the home with her clients, set the tone for that conversation with something bold: Two big stately glazed ceramic pots to each side of the door, each filled with spectacular foliage plants. While flowers seem to scream “Look at me!” in desperation, foliage plants exude grace and confidence. Plant them with something low-maintenance so that they thrive during the stressful move. Choose pots and plants that complement the colors and style of the house: A minimalist planting of snake plant or horsetail in sleek red pots may be appropriate for a mid-century modern home with a red door, but would be out of place on a Victorian porch.Prune the landscape

Notice that I said to prune not just the shrubs, but the entire landscape. It’s common knowledge that you should give your landscape plantings a trim before selling a home, but in the case of so-called ‘trash trees’ and overgrown foundation plantings, those hedge trimmers just aren’t enough. Anything this big should be removed by a professional so that you can focus on the important stuff. Now is also the time to evaluate the effectiveness of your landscape as a whole — not just to you, but everyone else. That vegetable patch or above-ground pool taking up your lawn might be paradise on earth to you and your family, but most prospective buyers will only see weeds and maintenance. However, some features, such as paved paths or patios, can actually bring value to the property because they make life easier without costing much time or effort.Make emotional connections with plants

Cookies in the oven are supposed to make buyers associate your home with their fondest memories, but well-chosen plants turn a house into someone’s home. Fragrant roses, jasmines and herbs will perfume the entry with nostalgia and make your house memorable to buyers. However, avoid placing strong-smelling plants too close to the entry, as this can be off-putting to some. Another trick is to incorporate plants that create a connection to the best features of your property. If it’s a waterfront property in the deep South, use palm trees to frame the view and create a sense of paradise. If the property offers a nice view of a prairie, plant a groundcover of ornamental grasses to connect the yard to the beauty beyond. Don’t skimp on the price either, because the bigger and nicer the plants, the bigger the impact. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.20750 N 87th St #1099 Scottsdale AZ 85255 | Encore at Grayhawk Homes for Sale

20750 N 87th St #1099 has a private Master suite w/surround sound, French door leading to yard, double sinks, closet with built-ins & walk-in shower.Gorgeous backyard with built-in BBQ, above ground built-in spa, tiled patio, view fencing with golf course views!

A SPECTACULAR setting at 20750 N 87th St #1099 for entertaining family and friends or just relax or Dine under the stars with a skyline of city lights. Enjoy all the amenities of The Encore of Grayhawk as well including clubhouse, fitness room & community pool & spa.

20750 N 87th St #1099 has a private Master suite w/surround sound, French door leading to yard, double sinks, closet with built-ins & walk-in shower.Gorgeous backyard with built-in BBQ, above ground built-in spa, tiled patio, view fencing with golf course views!

A SPECTACULAR setting at 20750 N 87th St #1099 for entertaining family and friends or just relax or Dine under the stars with a skyline of city lights. Enjoy all the amenities of The Encore of Grayhawk as well including clubhouse, fitness room & community pool & spa.

Contact Form

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.

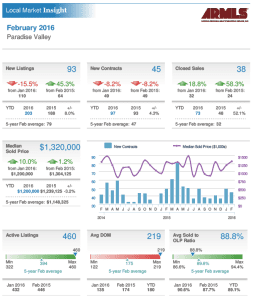

February 2016 Paradise Valley Arizona real estate market update – Arizona Luxury Homes

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at [email protected] or [email protected]. You can also visit https://www.AZLuxuryHomes.com or https://scottsdalerealestateteam.com to find out more about Paradise Valley Homes for Sale and Estates for Sale in Paradise Valley and to search the Paradise Valley MLS for Scottsdale Home Listings.

Please note that this Paradise Valley Real Estate Blog is for informational purposes and not intended to take the place of a licensed Paradise Valley Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale and Paradise Valley Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Paradise Valley, The Szabo group delivers experience, knowledge, dedication and proven results.

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at [email protected] or [email protected]. You can also visit https://www.AZLuxuryHomes.com or https://scottsdalerealestateteam.com to find out more about Paradise Valley Homes for Sale and Estates for Sale in Paradise Valley and to search the Paradise Valley MLS for Scottsdale Home Listings.

Please note that this Paradise Valley Real Estate Blog is for informational purposes and not intended to take the place of a licensed Paradise Valley Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale and Paradise Valley Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Paradise Valley, The Szabo group delivers experience, knowledge, dedication and proven results.The Do’s and Don’ts of Home Equity Loans By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

With home values rising, homeowners who have equity, a much-valued resource, might be tempted to tap some of that wealth and use it for other purposes. But depending on your personal situation and how you’d like to use the equity, it may not necessarily be the right thing to do.

Here’s when a home equity loan, which allows you to use the equity of your home as collateral, makes sense — and when it doesn’t.

By Joe Szabo, Scottsdale Real Estate Team

With home values rising, homeowners who have equity, a much-valued resource, might be tempted to tap some of that wealth and use it for other purposes. But depending on your personal situation and how you’d like to use the equity, it may not necessarily be the right thing to do.

Here’s when a home equity loan, which allows you to use the equity of your home as collateral, makes sense — and when it doesn’t.

DON’T: Fund a lifestyle

Remember a decade ago when homeowners yanked cash out of their homes as if they were bottomless piggy banks to fund affluent lifestyles they couldn’t really afford? These reckless borrowers, with their boats, fancy cars, lavish vacations, and other luxury items, paid the price when the housing bubble burst. Property values plunged, and they lost their homes. Lesson learned: Don’t squander your equity! A home equity loan should be looked at as an “investment,” and not as “extra cash” when making spending decisions.DO: Make home improvements

The safest use of home equity funds is for home improvements that will add to the home’s value. If you have a one-time project (for example, you need a new roof), then a home equity loan might make sense. Need access to money over a period of time to fund ongoing home improvement projects? Then a home equity line of credit (HELOC) would make more sense. HELOCs let you pay as you go, and usually have a variable rate that’s tied to the prime rate, plus or minus some percentage.DON’T: Pay for basic expenses/bills

This is a no-brainer, but it’s always worth reiterating: basic expenses like groceries, clothing, utilities, and phone bills should be a part of your household budget. If your budget doesn’t cover these and you’re thinking of borrowing money to afford them, it’s time to rework your budget and cut some of the excess.DO: Consolidate debt

Consolidating multiple balances, including your high-interest credit card debts, will make perfect sense when you run the numbers — who doesn’t want to save potentially thousands of dollars in interest? Debt consolidation will simplify your life, too, but beware: It only works if you have discipline. If you don’t, you’ll likely run all your balances back up again, and end up in even worse shape.DON’T: Finance college

This may seem like an attractive use of home equity for those with college-age children. However, the potential consequences down the road could be significant. And risky. Remember, tapping into your home equity may mean it takes you longer to pay off the loan. It also may delay your retirement, or put you even deeper in debt. Furthermore, as you get older, it will likely be more difficult to earn the money to pay back the loan. Don’t jeopardize your financial security. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.Merry Christmas! from Joe Szabo and the Scottsdale Real Estate Team

Merry Christmas from all of us at Scottsdale Real Estate.

We hope your holidays are unforgettable!

Happy Thanksgiving! from Joe Szabo and the Scottsdale Real Estate Team

October 2013 Paradise Valley Arizona real estate market update by Joe Szabo, Scottsdale Real Estate

Considering a purchasing or selling a property in Paradise Valley? Take advantage of the great market conditions and get your home listed for sale.

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at [email protected] or [email protected]. You can also visit https://www.AZLuxuryHomes.com or https://scottsdalerealestateteam.com to find out more about Paradise Valley Homes for Sale and Estates for Sale in Paradise Valley and to search the Paradise Valley MLS for Scottsdale Home Listings.

Please note that this Paradise Valley Real Estate Blog is for informational purposes and not intended to take the place of a licensed Paradise Valley Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale and Paradise Valley Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Paradise Valley, The Szabo group delivers experience, knowledge, dedication and proven results.

Considering a purchasing or selling a property in Paradise Valley? Take advantage of the great market conditions and get your home listed for sale.

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at [email protected] or [email protected]. You can also visit https://www.AZLuxuryHomes.com or https://scottsdalerealestateteam.com to find out more about Paradise Valley Homes for Sale and Estates for Sale in Paradise Valley and to search the Paradise Valley MLS for Scottsdale Home Listings.

Please note that this Paradise Valley Real Estate Blog is for informational purposes and not intended to take the place of a licensed Paradise Valley Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale and Paradise Valley Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Paradise Valley, The Szabo group delivers experience, knowledge, dedication and proven results.