5 Bathroom Renovation Mistakes to Avoid By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Read on to find out the five most common problems Devlin encounters — and how you can avoid them in your home.

By Joe Szabo, Scottsdale Real Estate Team

Read on to find out the five most common problems Devlin encounters — and how you can avoid them in your home.

Scottsdale Real Estate and Arizona Luxury Homes brought to you by the Scottsdale Real Estate Team

Search Scottsdale real estate and Paradise Valley real estate, MLS homes and condos for sale. Find the latest market data to help with your property search. Specializing in luxury homes, golf properties, condos and more.

By Joe Szabo, Scottsdale Real Estate Team

Read on to find out the five most common problems Devlin encounters — and how you can avoid them in your home.

By Joe Szabo, Scottsdale Real Estate Team

Read on to find out the five most common problems Devlin encounters — and how you can avoid them in your home.

dits

dits By Joe Szabo, Scottsdale Real Estate Team

Pet lovers no longer simply stick to sharing their homes with cats and dogs. More now opt for exotic or unusual pets such as snakes, monkeys, tigers, deer, bears and rare birds.

Accurate numbers are tough to come by, because some states don’t require residents to report ownership of exotic or specialty animals. But the American Veterinary Medical Association, through its 2012 U.S. Pet Ownership and Demographics Sourcebook, estimates that 10.6 percent of households own one or more exotic or specialty animals. And according to National Geographic, more exotic animals live in peoples’ homes than in zoos. For example, by some estimates, as many as 7,000 tigers live in the U.S. as pets.

Though exotic pets can make each day an adventure, people often forget to factor in the insurance complications associated with owning them. Your home insurance almost certainly excludes unusual pets. However, there are steps you can take to stay protected.

By Joe Szabo, Scottsdale Real Estate Team

Pet lovers no longer simply stick to sharing their homes with cats and dogs. More now opt for exotic or unusual pets such as snakes, monkeys, tigers, deer, bears and rare birds.

Accurate numbers are tough to come by, because some states don’t require residents to report ownership of exotic or specialty animals. But the American Veterinary Medical Association, through its 2012 U.S. Pet Ownership and Demographics Sourcebook, estimates that 10.6 percent of households own one or more exotic or specialty animals. And according to National Geographic, more exotic animals live in peoples’ homes than in zoos. For example, by some estimates, as many as 7,000 tigers live in the U.S. as pets.

Though exotic pets can make each day an adventure, people often forget to factor in the insurance complications associated with owning them. Your home insurance almost certainly excludes unusual pets. However, there are steps you can take to stay protected.

By Joe Szabo, Scottsdale Real Estate Team

If you’re thinking it’s time to sell your home, there are a few legal issues to consider before posting that “For Sale” sign. Whether you are parting ways with your spouse, planning to upgrade or downsize, or selling out of financial necessity, you should protect yourself from pitfalls awaiting the unsavvy seller.

Here are four steps you can take to avoid common issues that pop up during the residential home sale process.

By Joe Szabo, Scottsdale Real Estate Team

If you’re thinking it’s time to sell your home, there are a few legal issues to consider before posting that “For Sale” sign. Whether you are parting ways with your spouse, planning to upgrade or downsize, or selling out of financial necessity, you should protect yourself from pitfalls awaiting the unsavvy seller.

Here are four steps you can take to avoid common issues that pop up during the residential home sale process.

By Joe Szabo, Scottsdale Real Estate Team

Plenty of people live in tiny homes, small rooms, or just diminutive spaces. No matter what your reason for living in smaller quarters, you’ll undoubtedly have to make some compromises in your decorating.

To live happily and efficiently in smaller square footage, you’ll want to get organized and make some adjustments to your lifestyle. By making the most of color, strategic furniture buying, space planning and interesting lighting, your place can feel wonderfully “you” — with all the space you need.

By Joe Szabo, Scottsdale Real Estate Team

Plenty of people live in tiny homes, small rooms, or just diminutive spaces. No matter what your reason for living in smaller quarters, you’ll undoubtedly have to make some compromises in your decorating.

To live happily and efficiently in smaller square footage, you’ll want to get organized and make some adjustments to your lifestyle. By making the most of color, strategic furniture buying, space planning and interesting lighting, your place can feel wonderfully “you” — with all the space you need.

If you have large windows with beautiful views, add those colors to your room to unify the outside world with inside space and expand the look of your rooms. With the wonderful patterns and colors that outdoor fabrics offer, there is no reason to stop the “pretty party” at your interior.

Carrying coordinating materials outside for drapes, cushions and area rugs will only make your space look visually larger. On the interior, let as much natural light into a room as possible so it opens up the space and gives it character.Create organized storage wherever possible via built-in benches and use multi-purpose and storage furniture pieces, such as ottomans, so items that are less frequently used can be stowed away.

When it comes to cabinets and bookcases, do not fill up every shelf in a room; leave some of them half empty and spacious for an airy and more dramatic look. Where functional, remove as many doors as possible or use pocket doors to increase the sense of space.Light colors or neutrals are space expanders and provide a neutral background for furniture and artwork.

Using cool colors will make your walls appear to visually recede. Additionally, it is best to avoid unnecessary details, such as ruffles, in furniture and window treatments. Use simple paneled draperies or shades instead.Installing an oversized mirror or a set of smaller mirrors will add extra light, sparkle and make a small room appear larger. Even if a room is small, adding oversized artwork on a small wall or a statement light fixture overhead can create drama while making the space appear larger than it is.

You may also consider adding a floor-to-ceiling and wall-to-wall bookcase — this trick will create an impressive focal point and visually expand space by pushing the walls and ceiling out. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, info@ScottsdaleRealEstateTeam.com or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings. By Joe Szabo, Scottsdale Real Estate Team

Jackie Bigness and her family are finally ready to buy a home.

After years of renting, plus 8 months of living with her parents while they saved for a down payment, Bigness and her husband are house-hunting in earnest — and in the snow.

“Because we have such an early start [to house-hunting season] here in Chicago, we’ve been trudging through the snow — and what’s out there in our price range is insulting,” Bigness says. She hopes the listings will improve as home-selling season ramps up.

The Bignesses are at the front end of a wave of some 5.2 million renters who plan to buy homes in the next year, according to the Zillow Housing Confidence Index (ZHCI), which is sponsored by Zillow and developed by Pulsenomics LLC.

That’s an almost 25-percent boost from the same time last year.

Homeowners remain more confident overall than renters, but renter confidence is growing faster than homeowner confidence in 14 of the 20 metro areas surveyed.

People with the most confidence about the housing market are in San Jose, Miami and San Francisco. Confidence rose the most since last year among respondents in Dallas, Detroit and St. Louis.

“As home affordability continues to look great and rental affordability looks abysmal, many current renters clearly seem to be re-thinking their attitudes toward homeownership, and are expressing more confidence in the overall housing market as a result,” says Zillow Chief Economist Stan Humphries.

Still, Humphries cautions, wanting to buy is not the same as being able to. “Saving a down payment, qualifying for a mortgage and finding an affordable home to buy all remain formidable challenges for many,” he says.

The ZHCI polls homeowners and renters about housing market conditions, expectations for the future and their attitudes toward homeownership in general, across 20 large metro areas. You can read more about the results at https://www.zillow.com/research/housing-confidence-jan-2015-9097/.

Survey respondents were most confident in these places:

1. San Jose, CA

2. Miami, FL

3. San Francisco, CA

4. Dallas, TX

5. Los Angeles, CA

6. San Diego, CA

7. Washington, DC

8. Denver, CO

9. Phoenix, AZ

10. Seattle, WA

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, info@ScottsdaleRealEstateTeam.com or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

By Joe Szabo, Scottsdale Real Estate Team

Jackie Bigness and her family are finally ready to buy a home.

After years of renting, plus 8 months of living with her parents while they saved for a down payment, Bigness and her husband are house-hunting in earnest — and in the snow.

“Because we have such an early start [to house-hunting season] here in Chicago, we’ve been trudging through the snow — and what’s out there in our price range is insulting,” Bigness says. She hopes the listings will improve as home-selling season ramps up.

The Bignesses are at the front end of a wave of some 5.2 million renters who plan to buy homes in the next year, according to the Zillow Housing Confidence Index (ZHCI), which is sponsored by Zillow and developed by Pulsenomics LLC.

That’s an almost 25-percent boost from the same time last year.

Homeowners remain more confident overall than renters, but renter confidence is growing faster than homeowner confidence in 14 of the 20 metro areas surveyed.

People with the most confidence about the housing market are in San Jose, Miami and San Francisco. Confidence rose the most since last year among respondents in Dallas, Detroit and St. Louis.

“As home affordability continues to look great and rental affordability looks abysmal, many current renters clearly seem to be re-thinking their attitudes toward homeownership, and are expressing more confidence in the overall housing market as a result,” says Zillow Chief Economist Stan Humphries.

Still, Humphries cautions, wanting to buy is not the same as being able to. “Saving a down payment, qualifying for a mortgage and finding an affordable home to buy all remain formidable challenges for many,” he says.

The ZHCI polls homeowners and renters about housing market conditions, expectations for the future and their attitudes toward homeownership in general, across 20 large metro areas. You can read more about the results at https://www.zillow.com/research/housing-confidence-jan-2015-9097/.

Survey respondents were most confident in these places:

1. San Jose, CA

2. Miami, FL

3. San Francisco, CA

4. Dallas, TX

5. Los Angeles, CA

6. San Diego, CA

7. Washington, DC

8. Denver, CO

9. Phoenix, AZ

10. Seattle, WA

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, info@ScottsdaleRealEstateTeam.com or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings. By Joe Szabo, Scottsdale Real Estate Team

Owning real estate can make tax season more complex, but many homeowners receive considerable benefits — especially if they sold a home or relocated for a job in the previous year. Here’s a look at three ways homeownership can pay off at tax time.

By Joe Szabo, Scottsdale Real Estate Team

Owning real estate can make tax season more complex, but many homeowners receive considerable benefits — especially if they sold a home or relocated for a job in the previous year. Here’s a look at three ways homeownership can pay off at tax time.

“Rates remained flat for most of last week but jumped sharply after Friday’s exceptionally strong jobs report, before easing back down early this week,” said Erin Lantz, vice president of mortgages at Zillow. “We expect rates to hold steady this week due to little incoming data and the official start of the European Central Bank’s bond purchases.”

Additionally, the 15-year fixed mortgage rate this morning was 2.92 percent, and for 5/1 ARMs, the rate was 2.89 percent.

Check Zillow Mortgages for mortgage rate trends and up-to-the-minute mortgage rates for your state, or use the mortgage calculator to calculate monthly payments at the current rates.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, info@ScottsdaleRealEstateTeam.com or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

“Rates remained flat for most of last week but jumped sharply after Friday’s exceptionally strong jobs report, before easing back down early this week,” said Erin Lantz, vice president of mortgages at Zillow. “We expect rates to hold steady this week due to little incoming data and the official start of the European Central Bank’s bond purchases.”

Additionally, the 15-year fixed mortgage rate this morning was 2.92 percent, and for 5/1 ARMs, the rate was 2.89 percent.

Check Zillow Mortgages for mortgage rate trends and up-to-the-minute mortgage rates for your state, or use the mortgage calculator to calculate monthly payments at the current rates.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, info@ScottsdaleRealEstateTeam.com or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

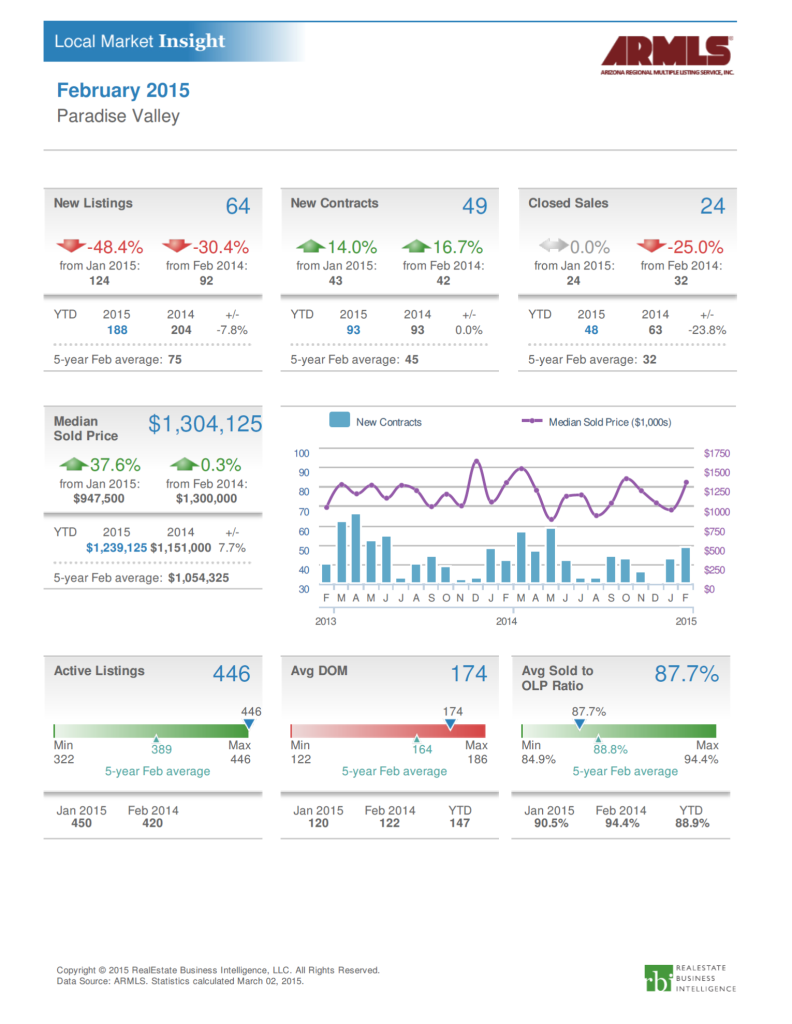

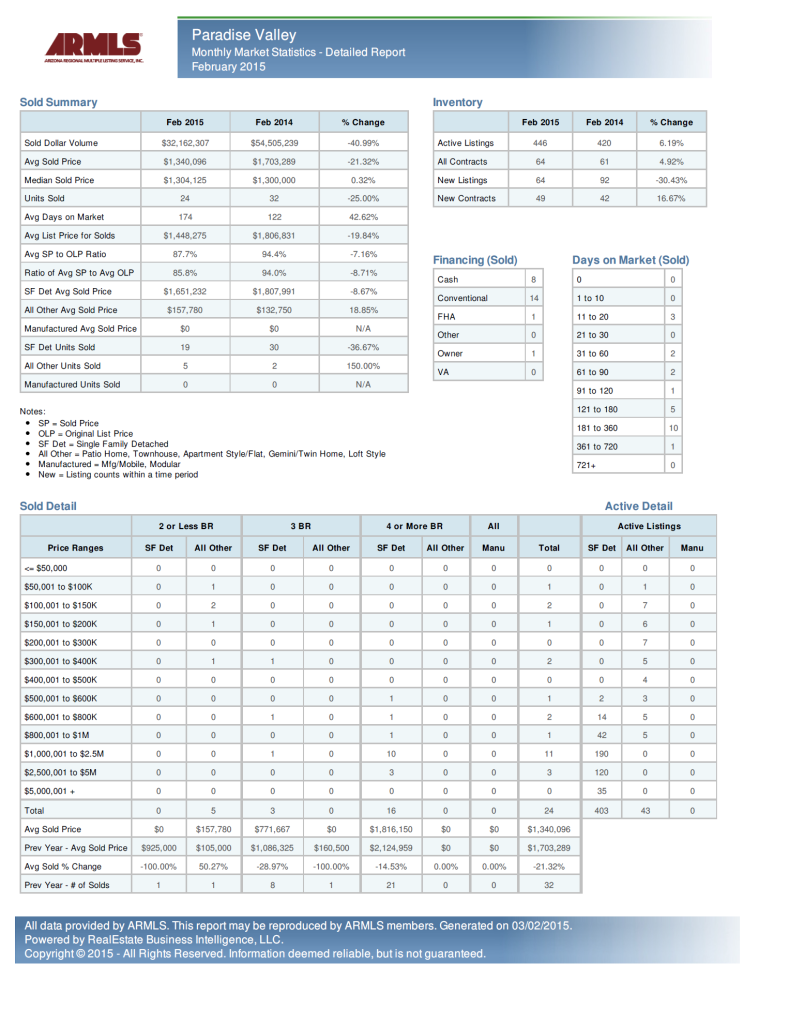

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at Joe@ScottsdaleRealEstateTeam.com or Joe@AZLuxuryHomes.com. You can also visit https://www.AZLuxuryHomes.com or https://scottsdalerealestateteam.com to find out more about Paradise Valley Homes for Sale and Estates for Sale in Paradise Valley and to search the Paradise Valley MLS for Scottsdale Home Listings.

Please note that this Paradise Valley Real Estate Blog is for informational purposes and not intended to take the place of a licensed Paradise Valley Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale and Paradise Valley Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Paradise Valley, The Szabo group delivers experience, knowledge, dedication and proven results.

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at Joe@ScottsdaleRealEstateTeam.com or Joe@AZLuxuryHomes.com. You can also visit https://www.AZLuxuryHomes.com or https://scottsdalerealestateteam.com to find out more about Paradise Valley Homes for Sale and Estates for Sale in Paradise Valley and to search the Paradise Valley MLS for Scottsdale Home Listings.

Please note that this Paradise Valley Real Estate Blog is for informational purposes and not intended to take the place of a licensed Paradise Valley Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale and Paradise Valley Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Paradise Valley, The Szabo group delivers experience, knowledge, dedication and proven results.

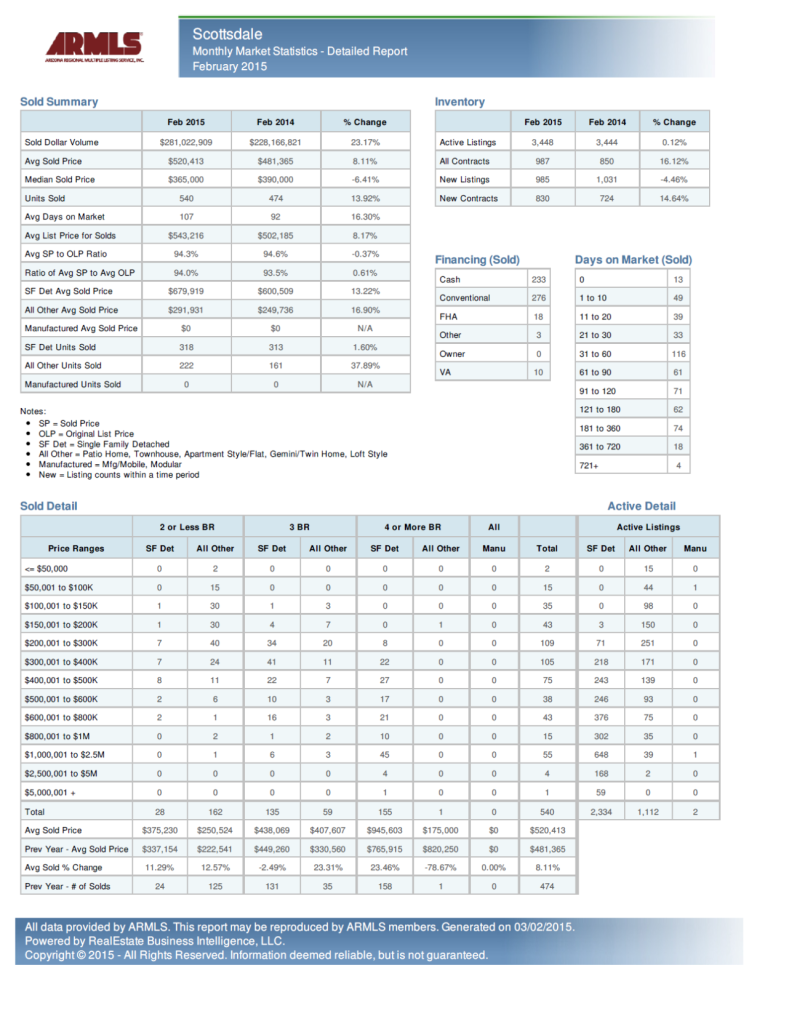

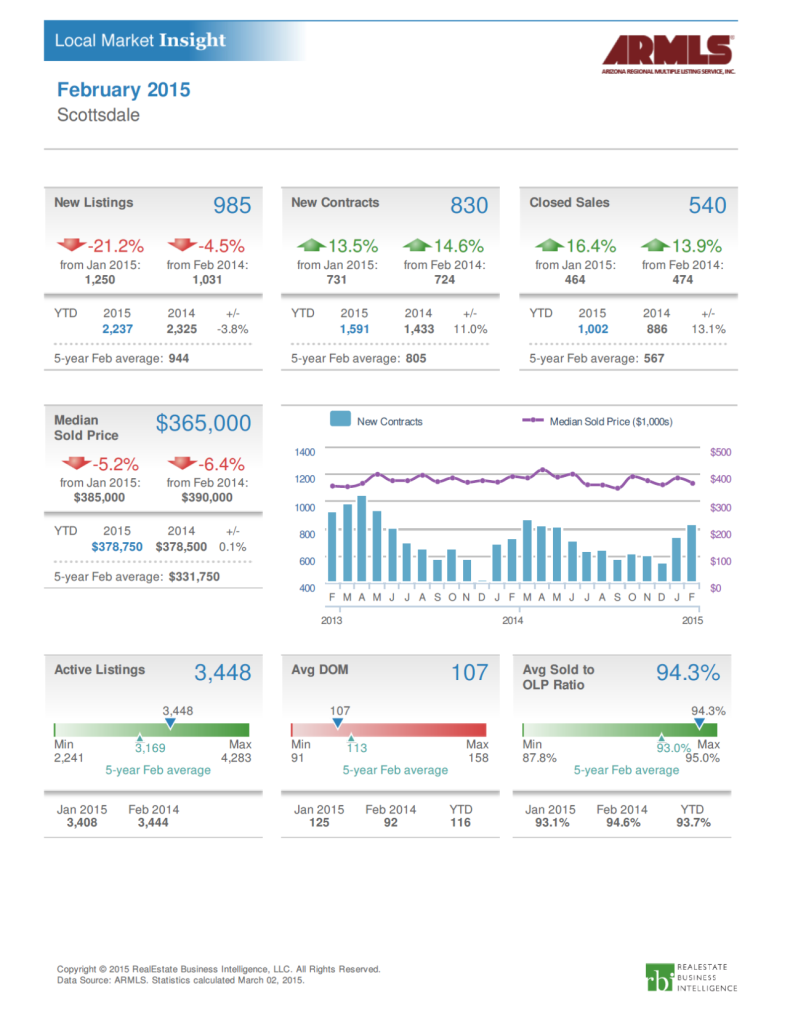

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at Joe@ScottsdaleRealEstateTeam.com. You can also visit https://scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results.

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at Joe@ScottsdaleRealEstateTeam.com. You can also visit https://scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results.

Mobile: 480-688-2020

Office: 480-889-8702

Fax: 480-355-9444

joe@azluxuryhomes.com

21000 N. Pima Rd

Suite 100

Scottsdale AZ, 85255

to save your favourite homes and more

Log in with emailDon't have an account? Sign up

Enter your email address and we will send you a link to change your password.

to save your favourite homes and more

Sign up with emailAlready have an account? Log in