Why Home Buyers and Agents Need to Have Each Other’s Backs By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Searching for a home and engaging with a real estate agent today is not the same as it was a generation ago. The space (both physical and virtual) between the buyer and the real estate agent was much larger, and coming together was slower and more methodical.

If a buyer saw a For Sale sign or an ad in the paper, they might call the real estate agency’s office, get some information, and move on. Or they could walk into an open house solo. They could be rather anonymous.

But today’s home buyers live online. They can click, text or email with agents, and seriously engage within hours. But does that mean they are active and serious buyers ready to transact? Not necessarily.

By Joe Szabo, Scottsdale Real Estate Team

Searching for a home and engaging with a real estate agent today is not the same as it was a generation ago. The space (both physical and virtual) between the buyer and the real estate agent was much larger, and coming together was slower and more methodical.

If a buyer saw a For Sale sign or an ad in the paper, they might call the real estate agency’s office, get some information, and move on. Or they could walk into an open house solo. They could be rather anonymous.

But today’s home buyers live online. They can click, text or email with agents, and seriously engage within hours. But does that mean they are active and serious buyers ready to transact? Not necessarily.

By

By  By

By  By

By

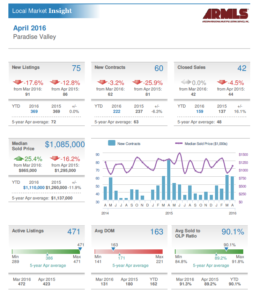

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

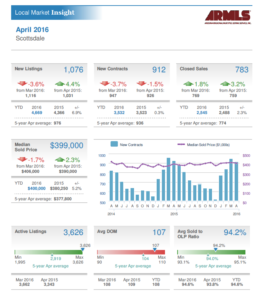

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at  By

By

By

By