We at Scottdale Real Estate Team off your best wishes for a wonderful holiday season and a new year filled with peace, prosperity and happiness. Happy holidays and a very happy 2018!

We at Scottdale Real Estate Team off your best wishes for a wonderful holiday season and a new year filled with peace, prosperity and happiness. Happy holidays and a very happy 2018!

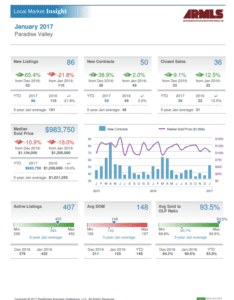

January 2017 Paradise Valley Arizona real estate market update

Can you believe it’s already February? Let’s take a look at how the Paradise Valley real estate market faired in January. New listings are up by 65.4% from December with a total of 86 new listings vs. 52 in December. The new listings in January were driven by homeowners waiting until after the holidays to list their home. New contracts were up in January by 38.9% with 50 new listings and closed sales went up with January numbers at 36 closed sales vs. 33 in December. The median sale is down from $1,104,000 in December to $983,750 in January. January closed with some motivating numbers – Sellers on the fence are strongly encouraged to take advantage of the low inventory and high demand! . During these up and down activity months it is more important than ever to consult a real estate professional that knows the Paradise Valley market.

If you’re considering to purchase or sell a property in Scottsdale we invite you to reach out to Joe and Linda Szabo with The Szabo Group – The Scottsdale Real Estate Experts! They and their team are more than happy to assist you with any of your real estate needs.

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at [email protected] or [email protected]. You can also visit https://www.AZLuxuryHomes.com or https://scottsdalerealestateteam.com to find out more about Paradise Valley Homes for Sale and Estates for Sale in Paradise Valley and to search the Paradise Valley MLS for Scottsdale Home Listings.

Please note that this Paradise Valley Real Estate Blog is for informational purposes and not intended to take the place of a licensed Paradise Valley Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale and Paradise Valley Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Paradise Valley, The Szabo group delivers experience, knowledge, dedication and proven results.

Can you believe it’s already February? Let’s take a look at how the Paradise Valley real estate market faired in January. New listings are up by 65.4% from December with a total of 86 new listings vs. 52 in December. The new listings in January were driven by homeowners waiting until after the holidays to list their home. New contracts were up in January by 38.9% with 50 new listings and closed sales went up with January numbers at 36 closed sales vs. 33 in December. The median sale is down from $1,104,000 in December to $983,750 in January. January closed with some motivating numbers – Sellers on the fence are strongly encouraged to take advantage of the low inventory and high demand! . During these up and down activity months it is more important than ever to consult a real estate professional that knows the Paradise Valley market.

If you’re considering to purchase or sell a property in Scottsdale we invite you to reach out to Joe and Linda Szabo with The Szabo Group – The Scottsdale Real Estate Experts! They and their team are more than happy to assist you with any of your real estate needs.

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at [email protected] or [email protected]. You can also visit https://www.AZLuxuryHomes.com or https://scottsdalerealestateteam.com to find out more about Paradise Valley Homes for Sale and Estates for Sale in Paradise Valley and to search the Paradise Valley MLS for Scottsdale Home Listings.

Please note that this Paradise Valley Real Estate Blog is for informational purposes and not intended to take the place of a licensed Paradise Valley Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale and Paradise Valley Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Paradise Valley, The Szabo group delivers experience, knowledge, dedication and proven results.October 2016 Paradise Valley Arizona Real Estate Market Update

The Do’s and Don’ts of Home Equity Loans By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

With home values rising, homeowners who have equity, a much-valued resource, might be tempted to tap some of that wealth and use it for other purposes. But depending on your personal situation and how you’d like to use the equity, it may not necessarily be the right thing to do.

Here’s when a home equity loan, which allows you to use the equity of your home as collateral, makes sense — and when it doesn’t.

By Joe Szabo, Scottsdale Real Estate Team

With home values rising, homeowners who have equity, a much-valued resource, might be tempted to tap some of that wealth and use it for other purposes. But depending on your personal situation and how you’d like to use the equity, it may not necessarily be the right thing to do.

Here’s when a home equity loan, which allows you to use the equity of your home as collateral, makes sense — and when it doesn’t.

DON’T: Fund a lifestyle

Remember a decade ago when homeowners yanked cash out of their homes as if they were bottomless piggy banks to fund affluent lifestyles they couldn’t really afford? These reckless borrowers, with their boats, fancy cars, lavish vacations, and other luxury items, paid the price when the housing bubble burst. Property values plunged, and they lost their homes. Lesson learned: Don’t squander your equity! A home equity loan should be looked at as an “investment,” and not as “extra cash” when making spending decisions.DO: Make home improvements

The safest use of home equity funds is for home improvements that will add to the home’s value. If you have a one-time project (for example, you need a new roof), then a home equity loan might make sense. Need access to money over a period of time to fund ongoing home improvement projects? Then a home equity line of credit (HELOC) would make more sense. HELOCs let you pay as you go, and usually have a variable rate that’s tied to the prime rate, plus or minus some percentage.DON’T: Pay for basic expenses/bills

This is a no-brainer, but it’s always worth reiterating: basic expenses like groceries, clothing, utilities, and phone bills should be a part of your household budget. If your budget doesn’t cover these and you’re thinking of borrowing money to afford them, it’s time to rework your budget and cut some of the excess.DO: Consolidate debt

Consolidating multiple balances, including your high-interest credit card debts, will make perfect sense when you run the numbers — who doesn’t want to save potentially thousands of dollars in interest? Debt consolidation will simplify your life, too, but beware: It only works if you have discipline. If you don’t, you’ll likely run all your balances back up again, and end up in even worse shape.DON’T: Finance college

This may seem like an attractive use of home equity for those with college-age children. However, the potential consequences down the road could be significant. And risky. Remember, tapping into your home equity may mean it takes you longer to pay off the loan. It also may delay your retirement, or put you even deeper in debt. Furthermore, as you get older, it will likely be more difficult to earn the money to pay back the loan. Don’t jeopardize your financial security. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.Everything You Need To Know About Cooling Your Home By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Summer may be lazy and hazy, but in many areas of the country, it’s also a time of sweating and sweltering in scorching temperatures. To cope, homeowners employ a variety of methods to ensure a steady supply of cool, fresh air.

These cooling solutions include a wide variety of fans and in-home ventilation systems as well as some tried-and-true techniques from the days before air conditioning. Here’s how to keep your whole home cool this season.

By Joe Szabo, Scottsdale Real Estate Team

Summer may be lazy and hazy, but in many areas of the country, it’s also a time of sweating and sweltering in scorching temperatures. To cope, homeowners employ a variety of methods to ensure a steady supply of cool, fresh air.

These cooling solutions include a wide variety of fans and in-home ventilation systems as well as some tried-and-true techniques from the days before air conditioning. Here’s how to keep your whole home cool this season.

The advent of air conditioners

By far the most common form of cooling in the United States is air conditioning, which can be found in more than 88 percent of new single-family homes constructed today. Keeping the house comfortable this way, however, can be a costly investment in terms of both equipment and energy use — we’re talking an average $400 household electric bill from June to August. So it makes good sense to carefully evaluate your home’s cooling options to select the right system to meet your needs.Keeping comfortable and cost-friendly

No matter what unit or system you choose, how you adjust your thermostat determines your ultimate savings on your electric bill. Start by setting the temperature as high as is still comfortable, keeping the difference between indoor and outdoor temperatures as small as possible. Take advantage of the “energy saver” mode on window units, and use programmable thermostats for multiroom or whole-house systems so your machines don’t do extra work to cool the place when nobody is home. When you’re ready to cool down, don’t drop immediately to an extremely cold temperature — starting that low won’t speed up the cooling process, but it will make your machine work harder and expend more energy. If you want to offer your machine — and your energy bills — a little relief, proper ventilation in your home can certainly aid your cool-down efforts. Ventilation improves indoor air quality, removes moisture and odors, and allows fresh, cool outside breezes to be exchanged for stuffy indoor air. Start boosting your home’s natural ventilation simply by opening doors and windows, especially in the evenings. Encourage airflow by installing ceiling fans, window fans, and attic exhaust fans to push hot air outside and draw cooler air into your home. In the summer months, ceiling fans should be set to run in a counterclockwise direction, drawing cooler air up from the floor. A whole-house attic exhaust fan will pull hot air into the attic, where attic vents can dissipate the heat. Even positioning a few portable fans near windows or a basement door at night can draw the cooler air from these areas into the home.Regular maintenance for maximum cool down

With a variety of cooling practices in place, you’ll want to maximize the efficiency of your efforts by performing proper maintenance.- Seal the deal. Make sure you have adequate insulation in the walls and ceilings to keep hot air out and cool air in. Caulk leaking windows and doors, and use draft “snakes” to cover the gaps at the bottom of these entry points. Adding aluminum blinds, insulated curtains, or window tint film can block even more sunlight from entering your home and heating up the place during the day.

- Change your filter. This quick and easy chore reduces the burden on your air conditioner, improves indoor air quality, and helps you — and your air conditioner — breathe easier. Check the filter once a month and clean out any dust particles that might clog the system, forcing it to work harder and waste energy.

- Clean the coils. An air conditioner’s coils and fins on the outside of the unit should be kept unobstructed and cleaned regularly. Use a soft-bristle nylon brush to gently remove any debris, and hose off any leaves or caked-on dirt. Clean the inside coils using the soft brush attachment on your vacuum cleaner, or wipe down with a soft, damp cloth.

- Call in a pro. Even though much of keeping your home cool can be considered do-it-yourself work, it is still important to call in a reputable HVAC contractor regularly. An annual system tune-up can help ensure that your air conditioning system is working efficiently and will go a long way toward prolonging the useful life of the components.

Hot Liability Issues in the Summertime By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Who doesn’t love summer? Hot fun such as waterparks, road trips, cookouts and boating generate part of the thrills. But for insurance providers, the word “thrills” translates to “risks.” And they hate risk. So do yourself a favor and reduce your risk — but not your fun — by following a few simple tips when taking on summer activities.

The payoff: fewer claims can translate into lower premiums. Then there’s also the fact that you can defend your wallet from having to shell out deductibles — the amount you agree to pay toward a claim before your provider helps.

By Joe Szabo, Scottsdale Real Estate Team

Who doesn’t love summer? Hot fun such as waterparks, road trips, cookouts and boating generate part of the thrills. But for insurance providers, the word “thrills” translates to “risks.” And they hate risk. So do yourself a favor and reduce your risk — but not your fun — by following a few simple tips when taking on summer activities.

The payoff: fewer claims can translate into lower premiums. Then there’s also the fact that you can defend your wallet from having to shell out deductibles — the amount you agree to pay toward a claim before your provider helps.

Keep kids safe in the water

Once school’s out, many kids head straight for the pool. But it’s important to reduce their risks of injury or drowning. More than 7.4 million pools are in residential and public use across the country, and there are more than 3,400 drownings each year, according to the Centers for Disease Control and Prevention. If you have a pool, it’s vital that your insurance company knows about it. That way, you can get help from your policy if you’re sued in connection with injuries — or worse — suffered by visitors. Want to decrease your liability risk when putting in a pool? Enclose the pool in a fence at least six feet tall, with a self-locking gate. Remember, you can be held liable for injuries suffered by children who trespass on your property. As for kids you invite to your pool, supervision is key. Chaperones should put away phones and other distractions to devote full attention to swimmers. Don’t leave kids alone in the pool even for a second. Make sure children who either don’t know how to swim or are not strong swimmers wear floaties or lifejackets when in the water. Finally, teach kids about the dangers of going near pool drains or filters, and educate yourself on how to turn these devices off in a hurry in the event of an emergency.Watercraft wisdom

If you’re heading to the lake or beach this summer, you should make sure that the insurance policies protecting your possessions are adequate. If you have a boat, consider coverage that includes:- Bodily injury liability

- Property damage liability

- Uninsured/underinsured watercraft coverage

- Property coverage

- Watercraft medical payments coverage

- Personal effects coverage

Hitting the open road

There’s nothing quite like driving to the beach or a nearby city during the summer to get a little change of pace. However, when backing out of the driveway, keep in mind that summer often yields more fatal car accidents than any other season. A number of factors contribute to this statistic, including:- Construction. Municipalities plan most of their yearly construction projects in the summer. When you encounter construction, be sure to adjust your speed and drive cautiously.

- Increased traffic. Great minds think alike, meaning that tons of people want to take some sort of vacation now, too. It’s basic math: the more people on the road, the more opportunity for wrecks.

- Young drivers. More kids get behind the wheel during the summer when school is out. Because they’re inexperienced, they may make bad decisions on the road.

- The sun and heat do a number on your vehicle. Your engine has more opportunities to overheat, and your tires could blow out because the air in them expands due to the warm weather. Get regular maintenance to ensure your vehicle is operating properly.

- More two-wheeled drivers. There are only so many months that cyclists and bikers can use their preferred modes of transportation.

In your own backyard

Summer cookouts bring together friends and family. But did you know that grill fires account for an average $37 million in damage, 100 injuries and 10 deaths per year, according to the U.S. Fire Administration? While fire typically is covered by standard home insurance, you don’t want to deal with one. To prevent grill fires, ensure that your grill is properly cleaned and stored. Check hoses for cracks, holes or other faults, store propane tanks away from your home if you have a gas grill, don’t cover or put away your grill until it has cooled, rinse charcoal with cool water before disposing of it, and keep a fire extinguisher nearby. Don’t grill in an enclosed area.

While grownups man the grill, kids may choose to jump around on the trampoline. Nearly 105,000 children visited emergency rooms last year for injuries caused by trampolines, according to the Consumer Product Safety Commission.

To prevent injuries, don’t take shortcuts when assembling the trampoline. Furthermore, pad the bars, springs and the surrounding areas, and get the trampoline as close to ground level as possible to reduce potential impact if a jumper falls.

Always supervise trampoline use, and let your insurance provider know about this type of addition to your home. You need a fence around it for the same reason you need one around a swimming pool on your property.

cleaned and stored. Check hoses for cracks, holes or other faults, store propane tanks away from your home if you have a gas grill, don’t cover or put away your grill until it has cooled, rinse charcoal with cool water before disposing of it, and keep a fire extinguisher nearby. Don’t grill in an enclosed area.

While grownups man the grill, kids may choose to jump around on the trampoline. Nearly 105,000 children visited emergency rooms last year for injuries caused by trampolines, according to the Consumer Product Safety Commission.

To prevent injuries, don’t take shortcuts when assembling the trampoline. Furthermore, pad the bars, springs and the surrounding areas, and get the trampoline as close to ground level as possible to reduce potential impact if a jumper falls.

Always supervise trampoline use, and let your insurance provider know about this type of addition to your home. You need a fence around it for the same reason you need one around a swimming pool on your property.

Pup protection

Dogs love to roam the yard when the weather is pleasant, but with more people out and about, too, your dog may feel the need to protect you. The Insurance Information Institute reports that more than $530 million in claims were paid in 2014 for dog bites — with an average payout of $32,072. If you have a dog, you need to make sure you have enough liability coverage in case it bites a guest or passerby. Keep Fido on a leash or in an enclosed area to reduce chances of bites. This summer, don’t cut down on the hot fun, but be sure to take steps to lower your risks while enjoying the great weather. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.Contingencies: A Home Buyer’s BFF By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Most home buyers organically begin and are comfortable with the real estate search process, but don’t know how to move forward once they’ve found a home they love. In order to put the search and discovery process into context, I sit down with every first-time buyer before we start searching together to go over the process, contract to close. If your agent hasn’t done this, ask them to.

One important aspect of a real estate contract is contingencies. These provisions for an unforeseen event or circumstance are important in case something goes south. At contract signing, buyers will put money in escrow — as little as $1,000 or up to 10 percent of the purchase price. That’s a lot of money to hand over to the seller before arranging financing and doing more due diligence than opening closet doors at the open house. Contingencies can help protect buyers if a problem arises.

Contingencies are always tied to a timeframe. If it’s a hard contingency, the buyer must sign off physically in writing. If it’s a soft contingency, it simply passes with time. Know the difference between the two, and mark your timeframes early.

Here are the three big contingencies to know.

By Joe Szabo, Scottsdale Real Estate Team

Most home buyers organically begin and are comfortable with the real estate search process, but don’t know how to move forward once they’ve found a home they love. In order to put the search and discovery process into context, I sit down with every first-time buyer before we start searching together to go over the process, contract to close. If your agent hasn’t done this, ask them to.

One important aspect of a real estate contract is contingencies. These provisions for an unforeseen event or circumstance are important in case something goes south. At contract signing, buyers will put money in escrow — as little as $1,000 or up to 10 percent of the purchase price. That’s a lot of money to hand over to the seller before arranging financing and doing more due diligence than opening closet doors at the open house. Contingencies can help protect buyers if a problem arises.

Contingencies are always tied to a timeframe. If it’s a hard contingency, the buyer must sign off physically in writing. If it’s a soft contingency, it simply passes with time. Know the difference between the two, and mark your timeframes early.

Here are the three big contingencies to know.

Inspections

The biggest and best of the contingencies, the inspection is the “get out of jail free card” for buyers. It allows you to walk away once you’ve had an inspection if you discover issues with the home. For example, it is common for buyers to uncover broken or defective items, older systems or health and safety issues. Some argue that it would be difficult to exit a contract from a brand new and flawless home, but the inspection contingency language in most contracts provides for an easy out. If you do find something unexpected, you don’t necessarily have to abandon the contract. Go back to the seller and see what they will fix. Unexpected inspection issues often result in a second round of negotiations. If the items are big enough to kill the deal, the seller may agree to fix them or issue a credit at closing. In competitive markets, the seller may leave the defects for you to deal with as the new owner.Loan approval and home appraisal

Getting pre-approved prior to making an offer is only part of the lending process. Before it wires the funds for your mortgage, the bank wants to be sure that the property is worth what you offered the seller, by way of an appraisal (sometimes a standalone contingency). The appraiser is an independent third party who will walk through the home, take pictures and measurements, and comment on its condition, then follow up with a written report. Second, a title report will be issued so the lender can see if there are outstanding liens or clouds on title. For condominiums or planned unit developments, the bank wants to review the governing documents and financials to make sure all is in order. The loan approval, which can take up to 60 days, is the longest contingency. In competitive markets, it can be done in less than two weeks. Be in touch with your lender before you make an offer, and strategize on timeframes.Disclosures

Disclosures are meant to provide the buyer with as much information as possible to make an informed decision, as well protect their soon-to-be interest. Sellers in most markets must disclose, via boilerplate local or state forms, their knowledge about the property and their experience living there. For example, if there was a leaky roof or if they know about a neighboring development that could affect the home’s value, they must disclose it. Typically, sellers deliver the disclosures to buyers after their offer is accepted. Additionally, buyers will review local building department documents alongside local, state or federal disclosures about anything from earthquake hazard zones to flood zones to disclosures about proximity to airports. Don’t sign a contract without reviewing your contingency options with your agent. Understand that contingencies are terms, and can sometimes be used for negotiation. If you can’t offer the highest price, the seller may appreciate moving fast once you sign a contract. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.How to Budget for Home Renovations By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Ready for a new kitchen? Anxious to redo the bathroom? The easy part is knowing what you want to remodel and why — whether you’re trying to keep up with your growing family, add office space, or increase your home’s value.

But figuring out how to renovate without breaking the bank can be tricky. Here are five key steps in planning your home renovation project.

By Joe Szabo, Scottsdale Real Estate Team

Ready for a new kitchen? Anxious to redo the bathroom? The easy part is knowing what you want to remodel and why — whether you’re trying to keep up with your growing family, add office space, or increase your home’s value.

But figuring out how to renovate without breaking the bank can be tricky. Here are five key steps in planning your home renovation project.

Estimate costs

As a general rule of thumb, you should spend no more on each room than the value of that room as a percentage of your overall house value. (Get an approximate value of your home to start with.) For example, a kitchen generally accounts for 10 to 15 percent of the property value, so spend no more than this on a renovation. If your home is worth $200,000, for example, you’ll want to spend $30,000 or less. Something else to keep in mind: contrary to popular belief, kitchen renovations offer among the lowest return on investment, according to analysis from Zillow Talk: The New Rules of Real Estate. Every dollar you spend on a new kitchen only increases the value of your home by 50 cents. The highest return on investment? A mid-range bathroom remodel.Consider loan options

If you’re borrowing money for the project, assess how much the bank will lend you (be sure to shop around!), and determine what type of loan would work best for you. If you have a one-time project, then a home equity loan might make sense. If, however, you need access to money over a period of time to fund ongoing home improvement expenses, then a home equity line of credit is preferable.Get quotes from contractors

Some contractors will give you an estimate based on what they think you want done, and work completed under these circumstances is almost guaranteed to cost more. You have to be very specific about what you want done, and spell it out in the contract — right down to the materials you’d like used. Get quotes from several contractors, tossing out the bid from the one who gives you the lowest estimate. Going with this choice could be asking for problems, as low-priced contractors are known to cut corners — at your expense.Stick to the plan

As the renovation moves along, you might be tempted to add on another “small” project or incorporate the newest design trend at the last minute. But know that every time you change your mind, there’s a change order, and even minor changes can be costly. Strive to stick to the original agreement, if possible.Account for hidden costs

Your home may look perfect on the outside, but there could be issues lurking beneath the surface. In fact, hidden imperfections are one of the reasons renovation projects end up costing more than you anticipated. Rather than scramble to come up with extra money after the fact, give yourself a cushion upfront. Factor in 10 to 20 percent (or more) of your contracted budget for unforeseen expenses, as they can — and do — occur. In fact, it’s rare that any project goes completely smoothly. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.The 5-Step Plan for Buying a Vacation Home By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

Do you dream of owning a vacation home, but find the idea of buying one too intimidating? It’s actually easier than you may think. Here’s a guide to help you analyze your options.

By Joe Szabo, Scottsdale Real Estate Team

Do you dream of owning a vacation home, but find the idea of buying one too intimidating? It’s actually easier than you may think. Here’s a guide to help you analyze your options.

1. Match housing choices to your lifestyle

Many people assume they must own a primary residence before owning a vacation home, but this isn’t a rule you must follow. What’s really important is matching your housing choices to your lifestyle. You may live in a city and want lots of space that you can’t afford there. You could rent a modest condo in the city, and buy a large vacation home outside the metro area. Or you may live in a large country house and want to enjoy city life as much as you can. In that case, you could own your country home and also buy a vacation condo in the city. Either way, the financing and tax implications are almost the same.2. Determine how you’ll use your vacation home

From a financing and tax standpoint, you need to consider how you intend to own and use your property. You have three options:- Primary residence. You can buy for as little as 3 percent down (if your loan doesn’t exceed $417,000), mortgage rates are the lowest they can be, and you get significant homeowner tax benefits.

- Second home. You can use your second home any time you want, but lenders won’t let you rent the home. Buy for as little as 20 percent down, and qualify for the loan using your full primary residence cost plus your full second home cost. Mortgage rates and tax benefits are the same as primary residences.

- Investment property. You can rent the home, plus use it when it’s not rented. Rates are .25 percent to .375 percent higher than second home rates, and your down payment usually starts at 30 percent. You qualify for the loan using your full primary residence cost plus your full investment home cost, but you can use rental income to help qualify. Tax treatment is less beneficial, but the extra income can help with affordability.

3. Understand the total cost of owning a vacation home

You can determine what you can afford in seconds. Then you’ll find a lender to formally analyze the cash available for down payment, closing costs, and reserves. You’ll also calculate the total monthly cost on your existing home (whether you rent or own), plus the total monthly cost on the vacation home. You also need to plan for personal budget items that lenders don’t use in their qualifying calculations:- Gas, electric, cable TV, and internet

- Furniture and housewares

- Travel costs to your vacation home

- Total cost of property maintenance items like cleaning, landscaping, and pool/spa upkeep

4. Review monthly and transactional cost line items

Suppose you live in San Francisco and want to purchase a home in the wine country of Sonoma County, CA for $600,000. Here’s how much it would cost as a primary residence, second home and investment property.| Primary Residence or Second Home | Investment Property | |

| Estimated monthly costs | ||

| Mortgage payment | $2,223 (30-year fixed mortgage at 3.75%) | $2,035 (30-year fixed mortgage at 4.125%) |

| Insurance | $100 | $100 |

| Property tax | $600 | $600 |

| TOTAL ESTIMATED MONTHLY COSTS | $2,923 | $2,735 |

| Estimated cash to close | ||

| Down payment | $120,000 (20%) | $180,000 (30%) |

| Lender fees | $2,500 | $2,500 |

| Title/escrow/inspection fees | $3,500 | $3,500 |

| TOTAL ESTIMATED CASH TO CLOSE | $126,000 | $186,000 |

5. Make an offer using a local realtor and lender

Many vacation properties are in specialized local markets, so it’s best to find local real estate agents and lenders. Your real estate agent will clarify local transaction fees, taxes and commissions, as well as advise on local zoning and property rental rules. For example, the town of Sonoma doesn’t allow short-term rentals for vacation homes, but other towns in Sonoma County do allow this. In destination areas, real estate agent commissions can be higher and can also be seller- or buyer-paid, depending on the area. Only a local expert can advise properly. And, of course, they will structure your offer for you, and negotiate on all facets of the deal that are a priority to you. Likewise, local lenders will be comfortable with appraisals and lending in rural areas. Appraisals are more difficult in less populated areas because comparable sales can be old and hard to find. If you follow these steps, your closing will be a snap, and you’ll be relaxing in your vacation home before you know it. Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.Home Buyers: 3 Signs It’s Time to Enlist a Real Estate Pro By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

The growth of online real estate listings means consumers are equipped with information very early in the home buying process. A generation ago, to get listing information and access to historical data, home buyers needed to connect with a real estate agent much sooner — sometimes even prematurely. But today’s home buyers can do a lot of the legwork themselves, conducting research online and using home search and research applications independently, in addition to attending open houses.

But this access to information doesn’t mean home shoppers can entirely go it alone. Buying a home is a major transaction, and all the data in the world can’t replace a knowledgeable and experienced local real estate agent.

Here are some signs that you are ready to engage with a buyer’s agent:

By Joe Szabo, Scottsdale Real Estate Team

The growth of online real estate listings means consumers are equipped with information very early in the home buying process. A generation ago, to get listing information and access to historical data, home buyers needed to connect with a real estate agent much sooner — sometimes even prematurely. But today’s home buyers can do a lot of the legwork themselves, conducting research online and using home search and research applications independently, in addition to attending open houses.

But this access to information doesn’t mean home shoppers can entirely go it alone. Buying a home is a major transaction, and all the data in the world can’t replace a knowledgeable and experienced local real estate agent.

Here are some signs that you are ready to engage with a buyer’s agent: