Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.Irish Luck or Just Good Timing, These Home Buyers are Rolling in the Green By Joe Szabo, Scottsdale Real Estate Team

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results. Contact Joe Szabo at 480.688.2020, [email protected] or visit www.scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

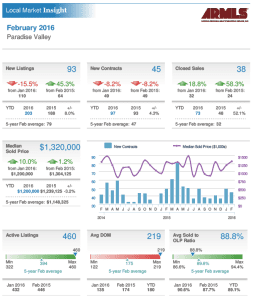

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

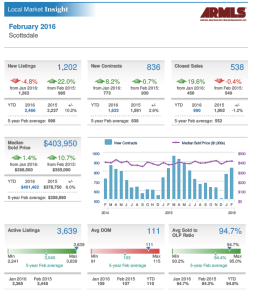

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at  By

By  By

By  By

By  By

By  12201 E Mountain View Rd has a beautiful Kitchen with granite countertops, large island, water ionizer, breakfast room, double ovens, built-in desk and French doors leading to backyard. Other features include: multiple patios off rooms, travertine and wood flooring throughout, dining room with high ceilings and skylight, charming Den off Master bedroom with wood flooring and French doors opening to front courtyard, Master retreat with wood flooring, beehive fireplace, sitting area, jetted tub, walk-in travertine shower, double sinks, makeup vanity & French doors leading to backyard, 2 car side load garage with storage closet & epoxy finish.

Backyard with large Pebble Tec pool, Saltillo tile patio with ceiling fan, artificial grass, built-in BBQ & more. This home is special! A must see!

12201 E Mountain View Rd has a beautiful Kitchen with granite countertops, large island, water ionizer, breakfast room, double ovens, built-in desk and French doors leading to backyard. Other features include: multiple patios off rooms, travertine and wood flooring throughout, dining room with high ceilings and skylight, charming Den off Master bedroom with wood flooring and French doors opening to front courtyard, Master retreat with wood flooring, beehive fireplace, sitting area, jetted tub, walk-in travertine shower, double sinks, makeup vanity & French doors leading to backyard, 2 car side load garage with storage closet & epoxy finish.

Backyard with large Pebble Tec pool, Saltillo tile patio with ceiling fan, artificial grass, built-in BBQ & more. This home is special! A must see! At 8230 E Sutton Dr Scottsdale AZ 85260, every detail is attended to in this beautiful home: exterior just painted in 2016, interior authentic Venetian plaster walls, custom cabinetry with slab granite countertops in kitchen and all baths, chiseled edge limestone flooring, wine/corking room with gorgeous custom wrought iron door, 3 laundry areas, arched barrel ceilings & much more.

Incredible resort backyard paradise that is a entertainers dream with a huge heated pool/spa, fountains, sunken Ramada with outdoor kitchen/granite swim-up bar with refrig & sink, built in BBQ, detached guest house with full kitchen, great room, bedroom & attached garage. This home at 8230 E Sutton Drive is one of a kind estate is a must see! Great location, schools and convenient access to the 101!

Check out the home tour of 8230 E Sutton Dr Scottsdale AZ below:

At 8230 E Sutton Dr Scottsdale AZ 85260, every detail is attended to in this beautiful home: exterior just painted in 2016, interior authentic Venetian plaster walls, custom cabinetry with slab granite countertops in kitchen and all baths, chiseled edge limestone flooring, wine/corking room with gorgeous custom wrought iron door, 3 laundry areas, arched barrel ceilings & much more.

Incredible resort backyard paradise that is a entertainers dream with a huge heated pool/spa, fountains, sunken Ramada with outdoor kitchen/granite swim-up bar with refrig & sink, built in BBQ, detached guest house with full kitchen, great room, bedroom & attached garage. This home at 8230 E Sutton Drive is one of a kind estate is a must see! Great location, schools and convenient access to the 101!

Check out the home tour of 8230 E Sutton Dr Scottsdale AZ below:

By

By