What Should You Do If Your ARM Is Almost Out Of Time? By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

If you bought a home with an adjustable rate mortgage (ARM) thinking you’d sell the home before the ARM adjusted, you’re not alone. Many people buy homes with ARMs because they plan to relocate or upgrade to a larger home in the near- to medium-term.

But when plans change and you decide to stay, you must know what will happen to your ARM — and what you can do about it. Let’s take a look.

By Joe Szabo, Scottsdale Real Estate Team

If you bought a home with an adjustable rate mortgage (ARM) thinking you’d sell the home before the ARM adjusted, you’re not alone. Many people buy homes with ARMs because they plan to relocate or upgrade to a larger home in the near- to medium-term.

But when plans change and you decide to stay, you must know what will happen to your ARM — and what you can do about it. Let’s take a look.

ARM vs. fixed rates

ARMs help your budget because rates on ARMs are lower than they are for fixed loans. For example, today’s rates for a loan on a $300,000 home purchase with 20 percent down are 2.75 percent for a 5/1 ARM versus 3.5 percent for a 30-year fixed. In this scenario, the monthly 5/1 ARM payment ($980) is $98 cheaper than the 30-year fixed payment ($1,078). This ARM vs. fixed savings is significant no matter what your home purchase price is, and if you are in fact only keeping the home (or the loan) short term, it can be worth it.How to choose

The best way to determine whether you go with an ARM or a fixed loan is to peg your loan term as closely as you can to your expected time horizon in the home or the loan. Here are a few options to consider:- If you’re buying a home with plans to relocate and sell the home within five years, a 5/1 ARM would be a good option. If you’re planning to move within 10 years, a 10/1 ARM would be a good option. You can also get 3/1 and 7/1 ARMs.

- If you plan to pay the loan off within five years and keep the home, a 5/1 ARM would also be a good option.

- If you’re going to relocate but want to keep the home, a fixed loan would be a good option.

By

By  By

By

26345 N 88th Way Scottsdale, AZ 85255 has four bedrooms and 3.5 baths inside the main home, the spectacular owners suite boasts a spa like bathroom with free standing soaking tub, walk in shower, dual floating vanities and large walk in closet. The kitchen is artfully designed with sleek European cabinets and Bosch appliances. A granite waterfall island overlooks the family room with bi fold glass doors leading out to custom designed backyard for true indoor/outdoor living. The resort style backyard, concepted by Bianchi Design, is meticulously crafted and the attention to detail of the flawless outdoor space is an extension of the modern aesthetic indoors.

At 26345 N 88th Way Scottsdale, AZ the spectacular 1000 sq foot pool integrates a baja shelf with chaise lounges and water feature that flows into the glass mosaic spa. An outdoor shower, built in BBQ, putting green, bank seating, artificial grass, and outdoor dining area with a custom retractable awning along with sensational views truly make this a one of a kind space built for sensational entertaining. A spacious detached casita with private patio and separate living area compete this phenomenal home.

For more information about this home or other homes in Scottsdale, please contact us at 480.688.2020!

26345 N 88th Way Scottsdale, AZ 85255 has four bedrooms and 3.5 baths inside the main home, the spectacular owners suite boasts a spa like bathroom with free standing soaking tub, walk in shower, dual floating vanities and large walk in closet. The kitchen is artfully designed with sleek European cabinets and Bosch appliances. A granite waterfall island overlooks the family room with bi fold glass doors leading out to custom designed backyard for true indoor/outdoor living. The resort style backyard, concepted by Bianchi Design, is meticulously crafted and the attention to detail of the flawless outdoor space is an extension of the modern aesthetic indoors.

At 26345 N 88th Way Scottsdale, AZ the spectacular 1000 sq foot pool integrates a baja shelf with chaise lounges and water feature that flows into the glass mosaic spa. An outdoor shower, built in BBQ, putting green, bank seating, artificial grass, and outdoor dining area with a custom retractable awning along with sensational views truly make this a one of a kind space built for sensational entertaining. A spacious detached casita with private patio and separate living area compete this phenomenal home.

For more information about this home or other homes in Scottsdale, please contact us at 480.688.2020!

By

By  By

By

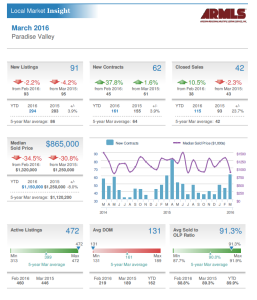

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Considering a purchasing or selling a property in Paradise Valley? Call Joe and Linda Szabo – The Real Estate Experts!

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

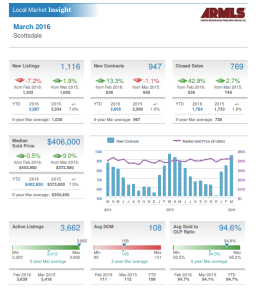

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Considering a purchasing or selling a property in Scottsdale? Call Joe and Linda Szabo – The Scottsdale Real Estate Experts!

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at