By Joe Szabo, Scottsdale Real Estate Team

If you’re anything like me, you may find that it’s all too easy to get caught up in the rush of flipping houses. I’ll admit — buying an old house, fixing it up, and flipping it for a profit is pretty exciting. But if you get too distracted by flipping houses, it’s easy to let your own home fall by the wayside.

While profitable remodeling projects can be more tempting to work on, you can still benefit from tackling projects in your own home. Remodeling your home will not only up its value, but also improve the way you feel about it. After all, who wouldn’t love to cook in a newly remodeled kitchen?

Here are five easy, inexpensive projects that will really make a difference in how you feel about your home.

By Joe Szabo, Scottsdale Real Estate Team

If you’re anything like me, you may find that it’s all too easy to get caught up in the rush of flipping houses. I’ll admit — buying an old house, fixing it up, and flipping it for a profit is pretty exciting. But if you get too distracted by flipping houses, it’s easy to let your own home fall by the wayside.

While profitable remodeling projects can be more tempting to work on, you can still benefit from tackling projects in your own home. Remodeling your home will not only up its value, but also improve the way you feel about it. After all, who wouldn’t love to cook in a newly remodeled kitchen?

Here are five easy, inexpensive projects that will really make a difference in how you feel about your home.

Easy and Inexpensive Ways to Fix Up Your Home Like a Flipper By Joe Szabo, Scottsdale Real Estate Team

By Joe Szabo, Scottsdale Real Estate Team

If you’re anything like me, you may find that it’s all too easy to get caught up in the rush of flipping houses. I’ll admit — buying an old house, fixing it up, and flipping it for a profit is pretty exciting. But if you get too distracted by flipping houses, it’s easy to let your own home fall by the wayside.

While profitable remodeling projects can be more tempting to work on, you can still benefit from tackling projects in your own home. Remodeling your home will not only up its value, but also improve the way you feel about it. After all, who wouldn’t love to cook in a newly remodeled kitchen?

Here are five easy, inexpensive projects that will really make a difference in how you feel about your home.

By Joe Szabo, Scottsdale Real Estate Team

If you’re anything like me, you may find that it’s all too easy to get caught up in the rush of flipping houses. I’ll admit — buying an old house, fixing it up, and flipping it for a profit is pretty exciting. But if you get too distracted by flipping houses, it’s easy to let your own home fall by the wayside.

While profitable remodeling projects can be more tempting to work on, you can still benefit from tackling projects in your own home. Remodeling your home will not only up its value, but also improve the way you feel about it. After all, who wouldn’t love to cook in a newly remodeled kitchen?

Here are five easy, inexpensive projects that will really make a difference in how you feel about your home.

By

By  By

By

If you’re considering to purchase or sell a property in Scottsdale we invite you to reach out to Joe and Linda Szabo with The Szabo Group – The Scottsdale Real Estate Experts! They and their team are more than happy to assist you with any of your real estate needs.

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at Joe@ScottsdaleRealEstateTeam.com. You can also visit https://scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results.

If you’re considering to purchase or sell a property in Scottsdale we invite you to reach out to Joe and Linda Szabo with The Szabo Group – The Scottsdale Real Estate Experts! They and their team are more than happy to assist you with any of your real estate needs.

We hope that you enjoy reading and analyzing the Scottsdale Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at Joe@ScottsdaleRealEstateTeam.com. You can also visit https://scottsdalerealestateteam.com to find out more about Scottsdale Homes for Sale and Estates for Sale in Scottsdale and to search the Scottsdale MLS for Scottsdale Home Listings.

Please note that this Scottsdale Real Estate Blog is for informational purposes and not intended to take the place of a licensed Scottsdale Real Estate Agent. The Szabo Group offers first class real estate services to clients in the Scottsdale Greater Phoenix Metropolitan Area in the buying and selling of Luxury homes in Arizona. Award winning Realtors and Re/MAX top producers and best real estate agent for Luxury Homes in Scottsdale, The Szabo group delivers experience, knowledge, dedication and proven results.

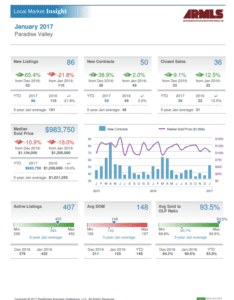

Can you believe it’s already February? Let’s take a look at how the Paradise Valley real estate market faired in January. New listings are up by 65.4% from December with a total of 86 new listings vs. 52 in December. The new listings in January were driven by homeowners waiting until after the holidays to list their home. New contracts were up in January by 38.9% with 50 new listings and closed sales went up with January numbers at 36 closed sales vs. 33 in December. The median sale is down from $1,104,000 in December to $983,750 in January. January closed with some motivating numbers – Sellers on the fence are strongly encouraged to take advantage of the low inventory and high demand! . During these up and down activity months it is more important than ever to consult a real estate professional that knows the Paradise Valley market.

If you’re considering to purchase or sell a property in Scottsdale we invite you to reach out to Joe and Linda Szabo with The Szabo Group – The Scottsdale Real Estate Experts! They and their team are more than happy to assist you with any of your real estate needs.

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at

Can you believe it’s already February? Let’s take a look at how the Paradise Valley real estate market faired in January. New listings are up by 65.4% from December with a total of 86 new listings vs. 52 in December. The new listings in January were driven by homeowners waiting until after the holidays to list their home. New contracts were up in January by 38.9% with 50 new listings and closed sales went up with January numbers at 36 closed sales vs. 33 in December. The median sale is down from $1,104,000 in December to $983,750 in January. January closed with some motivating numbers – Sellers on the fence are strongly encouraged to take advantage of the low inventory and high demand! . During these up and down activity months it is more important than ever to consult a real estate professional that knows the Paradise Valley market.

If you’re considering to purchase or sell a property in Scottsdale we invite you to reach out to Joe and Linda Szabo with The Szabo Group – The Scottsdale Real Estate Experts! They and their team are more than happy to assist you with any of your real estate needs.

We hope that you enjoy reading and analyzing the Paradise Valley Luxury Home Report and should you have any questions or comments, please feel free to Contact Joe Szabo at 480.688.2020 or email him directly at  By

By